A Complete Breakdown of Diploma in IFRS (2025)

1. Introduction: Why IFRS Knowledge is No Longer Optional, But Mandatory!!

In today’s competitive global market, standing still is the fastest way to fall behind. For finance and accounting professionals, the need to upskill is not just a suggestion; it’s a fundamental requirement for career survival and growth. As Saraf Academy’s founder, Prakash Saraf, often states, certain knowledge is no longer a choice.

“IFRS is no longer an optional knowledge, it’s a mandatory thing whichever domain you are working [in]… it’s a mandatory knowledge for accounts and finance professionals.”

The ACCA Diploma in IFRS is the globally recognized standard for mastering this essential skill. International Financial Reporting Standards (IFRS) are now the official accounting language in over 140 countries. As businesses expand across borders and investors demand transparent and comparable financial data, fluency in IFRS is non-negotiable.

This qualification is critical for:

Simply put, the question is no longer if you need IFRS, but when you will master it.

2. Real Career Transformations: Stories from Diploma IFRS Graduates

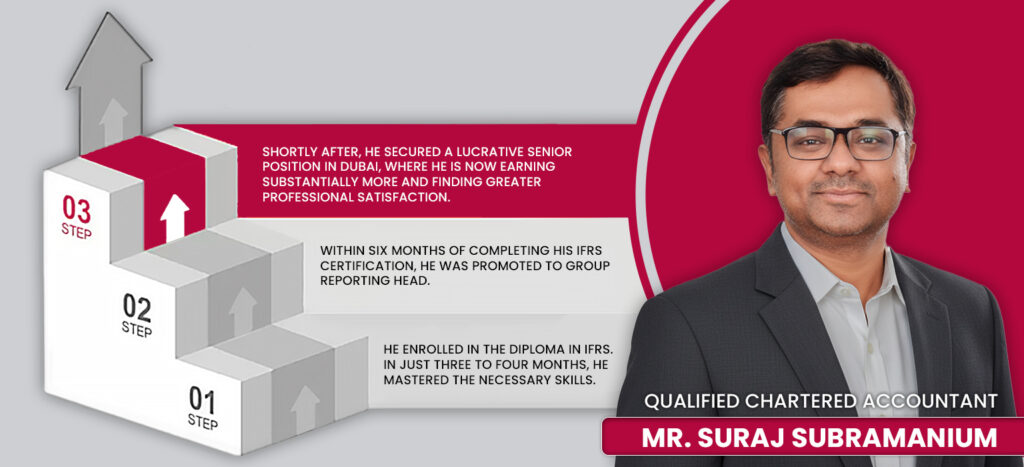

The true measure of any qualification lies in the tangible results it brings to professionals’ lives. These are not just theories; this knowledge creates real, life-changing opportunities. A perfect example is the story of one of our alumni, Mr. Subramanium.

Mr. Subramanium, a qualified Chartered Accountant, was working at a firm in India. His company began expanding, acquiring foreign subsidiaries that required consolidated group accounts prepared under IFRS. Suddenly, he faced a critical challenge: his deep knowledge of Indian GAAP was not enough to handle the complexities of international financial reporting. He was facing a problem.

The Solution: He enrolled in the Diploma in IFRS. In just three to four months, he mastered the necessary skills.

As Prakash Sir notes, “This is just an example. There are so many examples like this who have done IFRS… and what growth they got in life.”

Mr. Subramanium’s story is a powerful testament to the scope of IFRS. It shows how this one qualification can solve immediate workplace challenges, accelerate your career trajectory, and open doors to global opportunities you may have thought were years away.

3. The “Leasing” Example: How IFRS Changes Everything You Thought You Knew

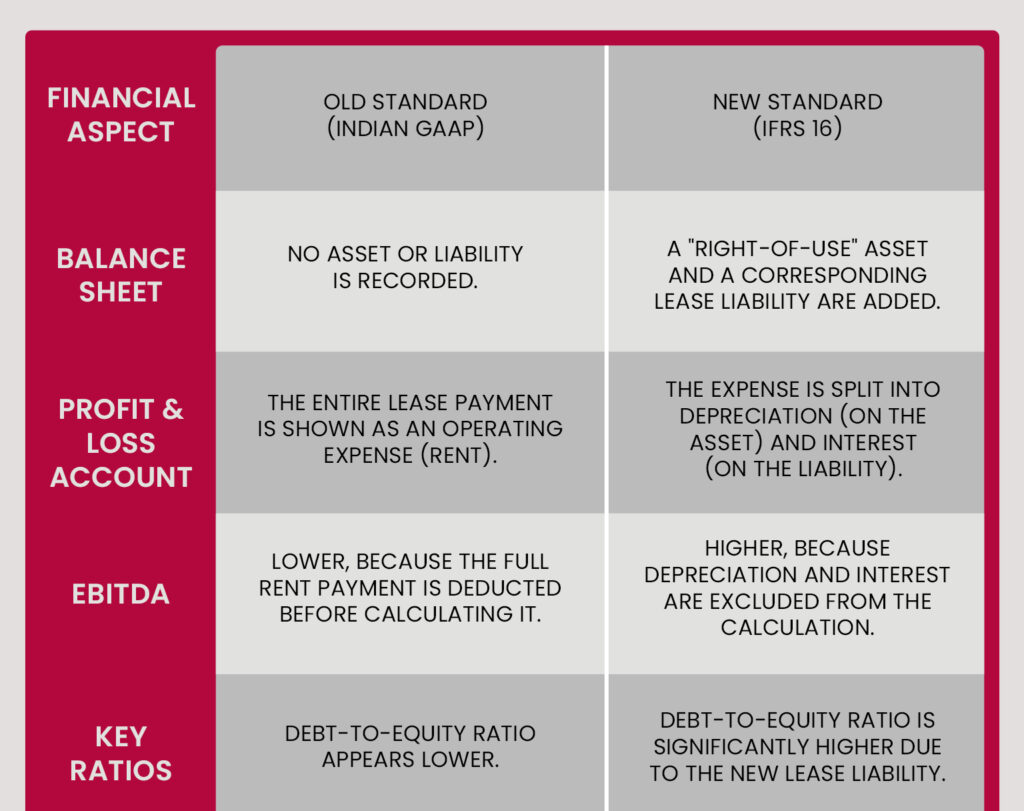

To truly understand why the Diploma in IFRS syllabus is so critical, let’s look at a practical example that Prakash Sir often uses to illustrate its game-changing impact: Lease Accounting (IFRS 16).

Imagine a large company, like an airline that leases 95% of its aircraft. Under the old accounting standards, the massive annual lease payments were simply treated as an operating expense, similar to rent. The valuable aircraft themselves never appeared on the balance sheet.

IFRS 16 changed everything. It argued that if a company controls an asset for years and derives economic benefit from it, it should be on the balance sheet, regardless of ownership.

Here’s how that one change transforms a company’s financials:

Why does this matter?

As Prakash Sir explains, “How can you work as a financial analyst, as an auditor… as an accounts controller… without having sound knowledge of IFRS?”

This single change affects a company’s borrowing capacity, its investor presentations, and how analysts value the business. Without understanding this, your financial analysis would be fundamentally flawed. This is just one standard – the IFRS course is filled with such critical, practical knowledge.

Of course. Here are the next three topics for your Diploma in IFRS blog. They are written in detail, formatted for clarity, and optimized with keywords, all while being deeply rooted in the authentic insights from Prakash Sir’s transcript.

4. A Transparent Look at Your Investment: Diploma IFRS Fees and Duration

One of the most powerful aspects of the ACCA Diploma in IFRS is that it offers an incredible return on a surprisingly modest investment of time and money. As Prakash Sir emphasizes, you can gain a globally demanded qualification in just a few months.

“By giving 3 to four months of your life, you are getting a professional qualification which is in huge demand… your investment is around maximum ₹45,000.”

Let’s break down the Diploma IFRS fees in India and the timeline so you have a completely transparent picture.

Your Total Investment

The total cost consists of your training fees with Saraf Academy and a separate exam fee paid directly to ACCA.

Course Duration: A Fast-Track to Expertise

The IFRS course duration is one of its most attractive features. The entire syllabus can be thoroughly mastered for the exam in just four months of consistent study.

Flexible Payment Options

We believe financial concerns shouldn’t hold back ambition.

- No-Cost EMI Facility: As Prakash Sir mentioned, we have arrangements for a no-cost EMI facility. You can pay your training fees in manageable monthly installments over six months, making this high-value certification accessible to all working professionals.

5. Career Opportunities & Salary After Diploma in IFRS

A qualification is only as valuable as the opportunities it creates. The Diploma in IFRS is one of the few certifications that delivers immediate, tangible career growth because the demand for IFRS experts far outstrips the supply.

In-Demand Job Roles for IFRS Professionals

Mastering IFRS opens doors to high-level, strategic roles across the finance domain. Based on the career paths of thousands of our alumni, here are some of the top IFRS jobs you can target:

- IFRS Specialist

- Financial Reporting Manager

- Statutory Auditor

- Consolidation Expert

- Group Accounts Controller

- Senior roles like Finance Manager and CFO

Top Industries Hiring IFRS Experts

The need for IFRS knowledge is universal. Our students are hired by the world’s leading companies across various sectors:

- The Big Four & Mid-Size Firms (Deloitte, PwC, EY, KPMG, Grant Thornton)

- Banking & NBFCs

- Manufacturing Giants (like Adani, Reliance, ITC)

- Consulting & IT Firms (Accenture, IBM, Wipro, Infosys, TCS)

- Multinational Corporations across India, the UK, Dubai, the US, and more.

Salary After Diploma in IFRS: A Significant Leap

Your earning potential sees a dramatic increase with IFRS expertise. Here are the realistic salary brackets based on our student data:

- For Freshers (with strong IFRS knowledge): ₹4 Lakhs to ₹8 Lakhs per annum.

- For Experienced Professionals (in India): The package can range from ₹8 Lakhs to ₹18 Lakhs per annum.

- For Global Professionals (Middle East/Europe): As Prakash Sir notes, with a higher cost of living and huge demand, salaries can be 50-100% higher. He cites the example of Mr. Subramanium, who received a “100% double salary in Dubai” after gaining his IFRS qualification.

6. Cracking the Diploma IFRS Exam: A Proven 4-Month Strategy ✓

The Diploma IFRS exam has a reputation for being challenging, but with the right strategy and guidance, it is entirely achievable for any dedicated professional. At Saraf Academy, we have a proven formula for success.

Understanding the Exam Format

First, let’s demystify the exam. It is a single, computer-based paper designed to test your practical application of the standards.

- Duration: 3 hours

- Structure: 4 compulsory questions, 25 marks each

- Question Type: All are essay-style, case-study-based questions. There are no multiple-choice questions.

- Passing Score: 50%

- Key Advantage: Because it’s essay-based, there is generous partial marking for logical steps and correct reasoning, even if the final answer isn’t perfect.

A Proven Strategy for Success: The 2-Hour Daily Formula

Prakash Sir is very clear about what it takes to pass. It’s not about marathon study sessions on weekends; it’s about consistency.

“I always say that… if you give me two hours regular study, I’m giving you a guarantee that in December you will pass the exam and you will have sound knowledge.”

This “2-Hour Daily Formula” is the cornerstone of our teaching. It’s a manageable commitment for working professionals and is proven to be more effective than irregular, long-hour cramming.

The Saraf Academy Pass Guarantee

We are so confident in this formula that we offer a straightforward guarantee.

- If you commit to the 2-hour daily study and attend the classes but are unable to pass the exam, you can attend the next batch of live classes and access all resources again, completely free of charge. We support you until you succeed.

The Diploma IFRS exam dates are held twice a year, in June and December, giving you two opportunities annually to achieve this career-changing certification.

7. The Saraf Academy Advantage: Why Our Live, Interactive Classes Deliver Results!

Choosing a certification is the first step; choosing the right mentor is what defines your journey. At Saraf Academy, we are built on Prakash Sir’s unwavering belief that true learning happens in a live, interactive environment, a philosophy honed over 30 years of teaching more than two lakh students.

When you search for the best IFRS course in India, you’re looking for a partner who is as committed to your success as you are. Here’s what makes our approach unique:

- The Unmatched Power of Live Classes: While others offer recordings, we prioritize real-time, online live classes. Why? Because learning isn’t passive. It’s about asking questions, engaging in discussions, and getting your doubts cleared instantly. As Prakash Sir says, “There is a time to start the class, there is no time to end the class.” This commitment means we stay until every student’s concept is clear.

- A Schedule Built for Working Professionals: We understand that you are balancing a demanding full-time job with your ambition to upskill. That’s why our entire learning structure is designed for the modern professional.

Our classes are always live and interactive, held two days a week to ensure a consistent yet manageable learning pace. Most importantly, all sessions are scheduled beyond office hours, typically on weekday evenings or weekends, so you never have to compromise your work commitments.

This rhythm gives you ample time between sessions to absorb, revise, and prepare. And if you ever have a scheduling conflict or want to review a complex topic? Every live class is fully supported by a complete recording, giving you the ultimate flexibility to learn on your own terms. This flexibility doesn’t mean you’re studying in isolation; you will always have direct access to our faculty, including Prakash Sir, to personally clear any doubts that arise from the recorded sessions.

- Teaching from the Ground Up: Are you worried the class will be too advanced? Don’t be.

“I need to assume that student don’t know anything… my discussion will always be starting from… basic sales, cost of goods sold, gross profit… balance sheet.” Whether you are a seasoned CA or a B.Com graduate, we start from the fundamentals to ensure everyone builds a rock-solid foundation.

- More Than a Teacher, a Lifelong Mentor: Our relationship doesn’t end with the exam. Prakash Sir regularly gets calls from students he taught years ago, seeking advice on practical, real-world IFRS challenges. This is the mark of a true mentor.

8. Who Should Do the Diploma in IFRS? (A Guide for CAs, Graduates & MBAs)

A common question we hear is, “Is the Diploma in IFRS right for me?” The answer is a resounding yes if you are an ambitious professional in the finance and accounting domain. This certification is specifically designed to bridge the gap between theoretical knowledge and the practical demands of the global industry.

Let’s break down who benefits most from an IFRS certification:

For Chartered Accountants (CAs) & CMAs

You are already a finance expert, but is your knowledge globally compliant? Prakash Sir notes that nearly half the students in his IFRS batches are already qualified CAs. Why?

- To Solve Real-World Problems: Many CAs, like Mr. Subramanium in our earlier example, face challenges with complex IFRS areas like consolidation of foreign subsidiaries, which may not have been covered in depth in their original studies.

- To Join the Big Four: As Prakash Sir states, “The big four always prefer, even though you are a CA, if you have IFRS certification they will always prefer you to hire.” It’s a key differentiator that makes your CV stand out.

For Finance Graduates (B.Com/M.Com) & MBAs

If you are a graduate with at least two years of work experience, the Diploma in IFRS is your fastest route to specialization.

- Stand Out from the Crowd: The job market is competitive. An IFRS certification instantly signals a specialized, in-demand skill set that generalist degrees don’t offer.

- Unlock Higher Salaries: It provides a direct path to higher-paying roles that require technical expertise in financial reporting.

For Auditors, Financial Analysts & Controllers

For professionals in these roles, IFRS knowledge is not just beneficial; it’s essential for performing your job effectively. Without it, how can you:

- Properly audit a company that uses IFRS 16 for its leases?

- Accurately analyze and value a company for a merger or acquisition?

- Approve credit for a client whose financials are prepared under IFRS? As Prakash Sir puts it, working in these domains without IFRS knowledge is simply “impossible.”

9. Your Next Step: Don’t Let Another 86,400 Seconds Go to Waste

We’ve covered why the Diploma in IFRS is a mandatory skill, the incredible career opportunities it unlocks, and the proven strategy to pass the exam. You have all the information you need. The final step, the most important one is your decision to act.

Prakash Sir often concludes his sessions with a powerful perspective on time:

“If you get 86,400 rupees in your account every day, and you need to use it that day or it’s gone… what will you do? … In a day, we get 86,400 seconds. But today’s 86,400 seconds cannot be used tomorrow. If you waste your time, you will repent, because you cannot get it back.”

Your time is your most valuable, non-renewable asset. Delaying a decision that will transform your career means another day, another 86,400 seconds, is lost forever.

Investing in your skills is the single best use of your time. It’s an investment that pays dividends for the rest of your life.

Don’t wait for the opportunity to come to you. Create it.

![Growing Demand for CMA US in India & Globally [2026] | CMA US Course | CMA US Online Coaching | Saraf Academy](https://saraf.academy/wp-content/uploads/2026/01/THUMBNAIL-300x188.jpg)

![ACCA & Employability [2026]: How to Build a Career That Travels the World | ACCA Course | ACCA By Saraf Academy](https://saraf.academy/wp-content/uploads/2025/12/THUMBNAIL-2-1-300x188.jpg)