Enrolled Agent [2026]: How to Start a US Tax Career from India (No Degree Needed)

1. Introduction: Unlocking the “Gold Mine” – What is an Enrolled Agent?

What if there was a prestigious, globally recognized US qualification that offered a massive return on investment, yet remained a well-kept secret among many finance professionals? According to Saraf Academy’s founder, Prakash Saraf, this opportunity is not just real-it’s a “gold mine” waiting to be discovered.

“Something’s a gold mine. If we don’t know, we’re not exercising it, and we’re not using this.”

This gold mine is the Enrolled Agent (EA) certification. So, what is an Enrolled Agent?

An Enrolled Agent is a federally-licensed tax practitioner who has unlimited rights to represent taxpayers before the IRS (Internal Revenue Service), the US equivalent of the Income Tax Department of India. This is the highest credential the IRS awards.

As an EA, you are empowered to handle all aspects of US taxation, just like a CPA who specializes in tax. This includes:

- Preparing and filing US tax returns for individuals, corporations, partnerships, and other entities.

- Representing clients during tax audits and disputes.

- Providing expert tax planning and advisory services.

One of the most powerful advantages of the EA license is that it’s a single, federal credential. Unlike a state-specific CPA license, an EA’s authority is recognized across all 50 US states, making you a truly national tax expert.

2. The “India Advantage”: Why the Demand for Enrolled Agent (EA) is Exploding Here

The biggest reason the Enrolled Agent certification is a “gold mine” for Indian professionals is a simple economic reality: “all the US work is done from India.”

As Prakash Sir explains, global corporations and the Big Four have shifted a massive volume of their US tax compliance and advisory work to India to leverage our country’s vast pool of skilled, affordable finance professionals. This has created an unprecedented demand for experts who are fluent in US tax law.

This “India Advantage” opens up two powerful career paths for Enrolled Agents:

High-Demand Corporate Jobs

The Big Four (Deloitte, PwC, EY, KPMG), IBM, Accenture, and thousands of other multinational corporations have large, ever-expanding US tax teams based in India. They are constantly looking for certified EAs to fill roles in tax compliance, advisory, and reporting. The scope of an Enrolled Agent in India within these corporate structures is massive and offers a stable, high-growth career.

The Freedom and Profit of Freelancing

The EA certification also empowers you to build your own practice without ever leaving India.

“You don’t need to work under anyone… you’ll be getting paid in dollars while your expenses will be in INR.”

Through global freelancing platforms and professional networking, you can acquire US-based clients directly. This powerful arbitrage-earning in a strong currency while living in a more affordable one-creates an incredible opportunity for financial independence and entrepreneurial success.

3. Enrolled Agent vs. CPA: The Specialist’s “Shortcut” to a US Tax Career

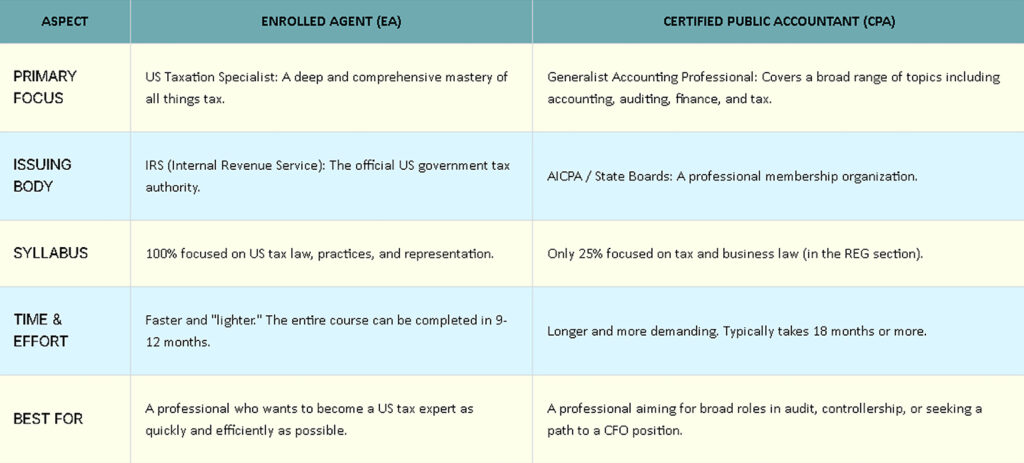

Many professionals considering a US qualification are often torn between the Enrolled Agent vs. CPA. While both are prestigious, they serve very different purposes. Understanding this difference is key to making the smart choice for your career.

As expert faculty Kaushal explains, the EA is the specialist’s “shortcut” to a career focused purely on US taxation.

“If you don’t want to do the CPA because you want to focus your career just on being an enrolled agent and solely on US taxation, then you can just go ahead and get your enrolled agent certification done… it gives you a shortcut.”

The CPA is a broad, comprehensive qualification, much like the Indian CA. The EA, on the other hand, is a deep, focused dive into one specific, high-demand area.

Here’s a clear comparison:

If your passion and career goal is to master US taxation, the Enrolled Agent certification is not just an alternative to the CPA-it’s the faster, smarter, and more focused choice.

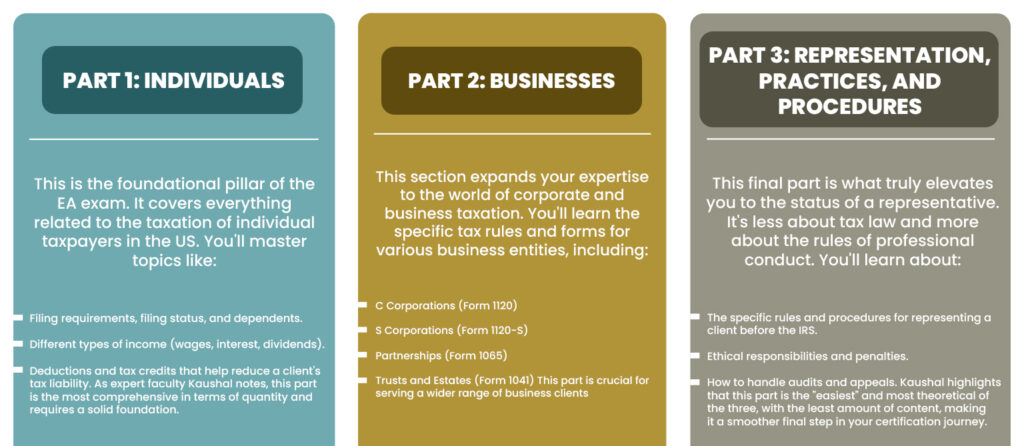

4. The Enrolled Agent (EA) Syllabus Unpacked: A 3-Part Journey to US Tax Mastery

The Enrolled Agent syllabus is logically structured into three distinct parts, each building upon the last to give you a comprehensive mastery of US taxation. Unlike broader qualifications, the EA curriculum is 100% focused on tax, making your learning journey efficient and highly specialized.

Here’s a simple breakdown of the three Enrolled Agent (EA) exam parts:

5. A Transparent Breakdown of Enrolled Agent Fees in India

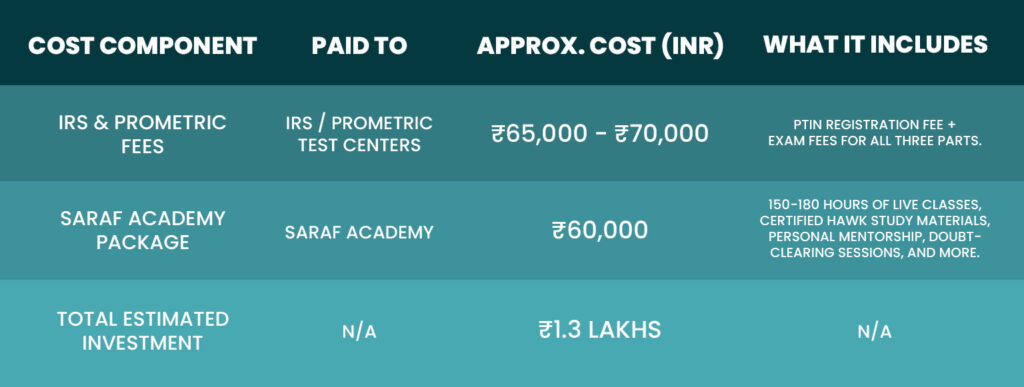

One of the most attractive aspects of the Enrolled Agent certification is its incredible return on investment. As Prakash Sir puts it, for a modest investment, you can unlock an income of ₹5-6 lakhs per year. To help you plan, here is a transparent breakdown of the Enrolled Agent (EA) certification cost.

The total investment to become an Enrolled Agent is approximately ₹1.3 Lakhs. This is a combination of fees paid directly to the US authorities and your all-inclusive training package with Saraf Academy.

*Note: Fees paid to the IRS and Prometric are in US Dollars ($) and the final INR amount can vary with currency fluctuations.

Flexible Payment Options

We believe that financial constraints should not be a barrier to ambition. To make this investment more manageable, Saraf Academy offers a no-cost EMI facility for our all-inclusive package. You can start your journey immediately and pay your fees in easy monthly installments.

6. Cracking the Enrolled Agent (EA) Exam: Your 9-Month Plan to Success

Can you pass a prestigious US qualification while managing a full-time job? With the Enrolled Agent exam, the answer is a resounding yes. The course is perfectly structured for working professionals.

Understanding the Exam Format

The EA exam pattern is straightforward and designed for focused preparation.

- Number of Exams: 3 separate parts, which you can take one at a time.

- Question Type: 100% Multiple-Choice Questions (MCQs).

- Exam Duration: 3.5 hours per part.

- Flexibility: You can schedule your exams at a Prometric test center on a date that is convenient for you (outside of the March-April blackout period).

A Proven Strategy for Success: The 1.5-Hour Daily Formula

The key to passing the EA exam isn’t about marathon study sessions; it’s about consistency. Prakash Sir recommends a realistic and highly effective approach:

“With regular study of around an hour and a half for 9 to 12 months… you’ll be done in about 9 months.”

This “1.5-Hour Daily Formula” is a manageable commitment for any working professional. By dedicating this focused time each day, you can build momentum without getting overwhelmed.

Here’s what your 9-month timeline could look like:

- Months 1-3: Master Part 1 (Individuals) and pass the exam.

- Months 4-6: Master Part 2 (Businesses) and pass the exam.

- Months 7-9: Master Part 3 (Representation) and become a certified Enrolled Agent.

This structured, step-by-step approach makes the goal of becoming a US tax expert achievable in under a year.

7. Career & Salary After Enrolled Agent: Your Path to ₹5-6 Lakhs/Year

A qualification is only as good as the career it helps you build. The Enrolled Agent certification offers one of the highest and fastest returns on investment in the finance world. As Prakash Sir states from his experience with thousands of students:

“You only need to invest between ₹1 Lakh to ₹1.3 Lakhs, and you’re getting something that can easily generate an income of ₹5 to ₹6 lakhs per year.”

This powerful ROI is driven by the massive demand for US tax experts. Here are the two main career paths you can pursue:

Path 1: High-Growth Corporate Jobs

The Big Four, IBM, Accenture, and countless other MNCs have large US tax processing teams in India. They are in constant need of certified professionals. The demand is so high that even local firms are actively hiring. Prakash Sir gives a real-world example:

“I heard about a tax firm called Mantra, which is right here in Kolkata… They need a regular person… If you’re a tax specialist, they’re ready to hire directly.” This creates a stable and lucrative job market for EAs right here in India.

Path 2: The Freedom of Freelancing & Your Own Practice

The EA license is your ticket to becoming your own boss. You can build a global practice from the comfort of your home.

- Find Clients Directly: You can leverage online platforms and social media to connect with and acquire clients directly from the US.

- Earn in Dollars: This is the ultimate financial advantage. You earn in a strong currency ($) while your living expenses are in rupees (₹), dramatically increasing your saving potential and financial freedom.

Whether you seek the security of a corporate role or the independence of your own practice, the Enrolled Agent salary and career prospects offer a life-changing opportunity.

8. Enrolled Agent Eligibility vs. CPA: Why Enrolled Agent (EA) is the Most Accessible US Qualification

One of the biggest questions for aspiring professionals is, “Am I eligible?” While premier US qualifications like the CPA have complex and demanding educational requirements, the Enrolled Agent eligibility is refreshingly simple and accessible.

This is, perhaps, the single biggest advantage of the EA course for a vast majority of Indian aspirants. It removes the barrier to entry that stops many from pursuing a US certification.

Here is a clear comparison:

| Eligibility Criteria | Enrolled Agent (EA) | CPA (Certified Public Accountant) |

| Educational Requirement | No specific degree required. A 12th pass-out can pursue it. | Equivalent of 4 years of university (120+ credit hours), often requiring a Master’s degree for Indian B.Com graduates. |

| Work Experience | Not required to sit for the exam. | Not required for the exam, but often needed for the final license. |

| Minimum Age | 18 years | Varies by state, but effectively requires a university degree. |

The Key Takeaway: The Enrolled Agent certification is the most accessible, high-value US finance qualification. You don’t need a Master’s degree or years of specific education to start. As long as you are over 18 and have the dedication to learn, you can begin your journey to becoming a respected US tax professional. This makes it the perfect starting point for a global career.

9. The Saraf Academy Advantage: Live Classes, Expert Faculty & End-to-End Support

Choosing a qualification is the first step; choosing the right training partner ensures you cross the finish line successfully. At Saraf Academy, we provide a comprehensive support system designed to turn your ambition into certification.

When you look for the best Enrolled Agent coaching in India, you need a partner who provides more than just videos. Here’s what makes our Enrolled Agent (EA) online classes different:

- Expert Faculty with Real-World Experience: Your classes are led by practicing professionals like Kaushal, a licensed US & Australian CPA based in Singapore. You learn from experts who are actively working in the field, giving you practical insights that go beyond the textbook.

- Premium Study Materials Included: We are partnered with Hawk International, a top-tier global review provider. Their premium study materials, including videos, textbooks, and a massive question bank, are included in your all-inclusive package.

- Live, Interactive Classes for Professionals: Our program is built around live, engaging classes held at convenient times for working professionals (Friday evenings and Sunday mornings). You can ask questions, participate in discussions, and get your doubts cleared in real-time.

- Complete Support System: Our commitment to you goes beyond the classroom.

- We provide guidance on how to find freelance work and build your practice after you qualify.

- We offer a no-cost EMI facility to make the course financially accessible.

- We provide personal mentorship and doubt-clearing support throughout your 9-month journey.

We don’t just teach you the syllabus; we give you the tools, mentorship, and support to build a successful career as an Enrolled Agent.

![Growing Demand for CMA US in India & Globally [2026] | CMA US Course | CMA US Online Coaching | Saraf Academy](https://saraf.academy/wp-content/uploads/2026/01/THUMBNAIL-300x188.jpg)

![ACCA & Employability [2026]: How to Build a Career That Travels the World | ACCA Course | ACCA By Saraf Academy](https://saraf.academy/wp-content/uploads/2025/12/THUMBNAIL-2-1-300x188.jpg)