CPA (US)

Certified Public Accountant

A Certified Public Accountant (CPA) is the highest standard of competence in the field of Accountancy across the globe.

Duration

4 Hours/ paper

Papers

4 Paper

Exams

On demand

Exam Pattern

50% objective 50% simulation

CPA

A Certified Public Accountant (CPA) is the highest standard of competence in the field of Accountancy across the globe. CPA is the American accounting course equivalent to the Indian Chartered Accountant qualification. CPA is specifically designed to meet the demands of modern accounting professionals of Chartered Accountant.

The exam is administered by the American Institute of Certified Public Accountants (AICPA), which is the world’s largest accounting body. If you ever consider a career in accounting and want an illustrious career, CPA Course is the best option for you. CPAs are globally recognized as premier accountants and are hired across industries throughout the world.

Advantages of doing CPA

- CPA's are often viewed as the elite group of professionals. After years of advance academics, training and passing the vigorous CPA exam, a CPA's ethics and character is fully tested and approved. They are immensely respected by their fellow members and clients.

- CPA professionals are highly in demand across the globe because of their expertise in area of accounts and finance.

- CPA licence gives commitment to the professional for a successful career and highlight their potential for leadership roles.

- Many people consider salary package as potential criteria while choosing a career. CPA licence gives you opportunity to earn more than a normal accountants by proving your expertise in the field of accounts and finance.

Why learn CPA with SARAF

- Best In Class Training Classes

- Video Lectures- Live & Recorded

- Mock Tests

- Study planner

- Comprehensive Progress Tests

- Exam Tips

- 360 Degree Support

CPA Course Eligibility

120 Credit hours

Graduate + CA qualified/ CA Inter qualified/ CMA qualified/ CMA Inter qualified

Graduation +75% / Graduation + MBA/MCom

CPA Course Syllabus

CPA course consist of 4 papers which are FAR, AUD, REG & BEC

- Conceptual Framework, Standard-Setting and Financial Reporting

- Select Financial Statement Accounts

- Select Transactions

- State and Local Governments

- Ethics, Professional Responsibilities and General Principles

- Assessing Risk and Developing a Planned Response

- Performing Further Procedures and Obtaining Evidence

- Forming Conclusions and Reporting

- Ethics, Professional Responsibilities and Federal Tax Procedures

- Business Law

- Federal Taxation of Property Transactions

- Federal Taxation of Individuals

- Federal Taxation of Entities

- Corporate Governance

- Economic Concepts and Analysis

- Financial Management

- Information Technology

- Operations Management

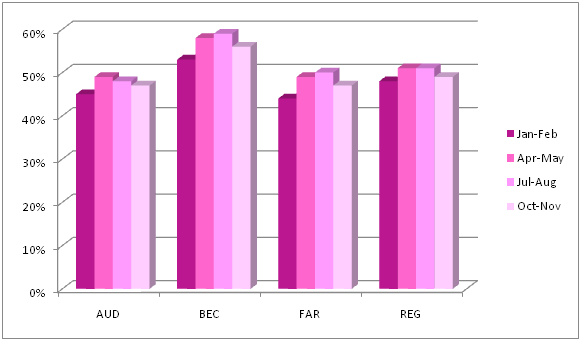

Exam Pass Rate

Salary

CPA professionals are offered salary of at least top six figures. As per the recent survey,

In USA, a newly qualified CPA with less than 1 years of work experience earn average salary of $66,000/year and CPAs with more than 20 years of experience average $152,000/year.

In India, the average salary of a CPA is Rs. 7,66,201/year.

Employment Opportunities

CPA professionals, considering the rigorous educational requirements and stringent norms pertaining to its qualification, are in high demand by PSUs, MNCs, the Big 4 consulting firms etc offering exciting career choices as an Auditor, Public Accountant, Management Accountant etc. CPA opens up the door to lucrative jobs in India and worldwide.

Live Class Schedule (For June 2024)

Course enrolment

Top blogs

Top Videos

CPA Playlist

CPA FAQs

Yes, it definitely gives you an upper hand if you do CPA after CA. CPA stands for Certified Public Accountant which is conferred by AICPA USA. It is the best Chartered Accountancy Course in the world. If you pursue CPA , after completing CA, you will get ample of job opportunities in MNCs and Big 4s. An Indian CA, also pursuing the CPA qualification broadens his career options. As a member of AICPA, they are able to undertake more diverse roles, work in more diverse industries as well as work with multinational organizations that require expertise of finance professionals who are trained with international standards.

In the wake of globalization, most of the top MNC’s like KPMG, Deloitte, PWC, EY, Microsoft, IBM, Nestle, Procter & Gamble, Wipro, Tata Consultancy Services, Accenture, IBM, Microsoft prefer candidates with a global qualification like CPA USA. So, if you want to give your career, an international edge after clearing CA, you should definitely opt for CPA USA.

Candidates must hold a graduate or postgraduate degree in commerce or a related field and have completed the necessary credit hours of accounting and business courses.

It is advisable to take 2 papers at a time in CPA USA, since you need to travel to Dubai or USA, to appear for the CPA USA examinations. Exams are being conducted 280 days during the year. Generally students take up FAR and AUD in one examination window followed by BEC and REG in the next level.

The CPA course is designed to be completed in 12-18 months, depending on the student’s pace and schedule

CPA professionals are finance professionals who have achieved expertise beyond a “normal” accountant through the vigorous education requirement and training.

Accountants who wants to more hike than a normal Accountant in their careers opt for CPA. Here are few benefits which a CPA enjoys:

Respected in their field: CPA’s are often viewed as the elite group of professionals. After years of advance academics, training and passing the vigorous CPA exam, a CPA’s ethics and character is fully tested and approved. They are immensely respected by their fellow members and clients.

Demand in industry: CPA professionals are highly in demand across the globe because of their expertise in area of accounts and finance.

Career Development: CPA licence gives commitment to the professional for a successful career and highlight their potential for leadership roles.

Better salary package: Many people consider salary package as potential criteria while choosing a career. CPA licence gives you opportunity to earn more than a normal accountants by proving your expertise in the field of accounts and finance.

CPA professionals are offered salary of at least top six figures. As per the recent survey, in USA, a newly qualified CPA with less than 1 years of work experience earn average salary of $66,000/year and CPAs with more than 20 years of experience average $152,000/year. In India, the average salary of a CPA is Rs. 7,66,201/year.

CPA professionals, considering the rigorous educational requirements and stringent norms pertaining to its qualification, are in high demand by PSUs, MNCs, the Big 4 consulting firms etc offering exciting career choices as an Auditor, Public Accountant, Management Accountant etc. CPA opens up the door to lucrative jobs in India and worldwide.

Top Companies hiring our students

What our students say

Sachin Shah

I am pursuing CPA. I joined Saraf academy from distance (Dubai). I am delighted to share that I have cleared my FAR with 80 now (2nd paper after BEC with 85). I am thankful to Saraf sir for his constant support and mentoring. He is my mentor and guide to achieve my goal.

Many times when I got long breaks during pursuing my studies due to any reason, Prakash sir was great motivator and guided exactly what was needed and helped me get back on track. He is always available and Cleared my subject doubts like consolidation, Govt accounting rules and valuation.

Sir, cannot think of clearing FAR without your support🙏 Thank you so much 💐

Neeraj Modi

As a working professional , I was looking for an educator who can give flexibility of time in teaching along with practical orientation to the studies. Eventually the excellent pedagogy of Prakash Saraf sir and the amazing help I received to enhance my skill and improve my knowledge with personal focus convinced me that i am in safe hands. I will recommend this place to all the CPA (US) candidates who are looking for personalised focus with practical examples

Boganadham Srikar

I am extremely happy with the Saraf Academy…. after completing CWA I was checking with my friends on IFRS then I got to know about Saraf Academy. The material is completely in layman language and the concepts were easily understandable…..now I am preparing for CPA US in his academy only…I am sure that, I am going to clear CPA as well with a very good score….I also need to say about the back end support team of Saraf Academy….the support team is also excellent…. they will even work in the odd timings to help the students. Finally, thanks for all your help and support