ACCA Exemption For CA: Complete Guide to Fees, Eligibility, and Application

The Chartered Accountancy (CA) degree is competitive in India, and whether you have previously completed it or are currently pursuing it, you may be considering how you might broaden your employment opportunities abroad. Although the Association of Chartered Certified Accountants (ACCA) holds significant value in India, its recognition in over 180 countries offers access to a global accounting profession.

Let us begin with some positive news. You don’t have to start from scratch if you’re a CA professional or student because you can benefit from substantial ACCA exemptions. Everything you need to know about the ACCA exemption for CA candidates—including qualifying conditions, costs, and the application process—can be found in this blog.

Is ACCA Worth Considering After CA?

CAs are among the most regarded accounting degrees in India, although many professionals aspire to work for multinational corporations (MNCs) or pursue chances outside. Through the utilization of relevant exemptions, professionals with CA qualifications can expedite and save costs on completing the ACCA qualification.

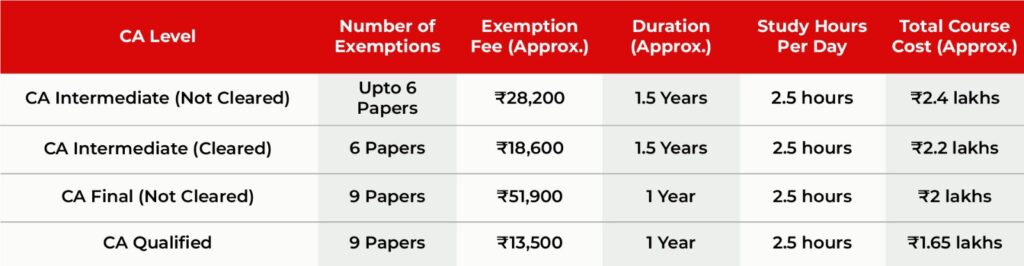

The main ACCA exemptions for CA candidates are broken down here.

ACCA Exemptions for CA Students and Qualified Professionals

Why ACCA Exemptions Are Beneficial

- Time Savings: Professionals who meet the CA qualification requirements only need to take 4 examinations, which reduces the amount of time needed to obtain ACCA certification.

- Cost Savings: Exam fees and preparation expenses are greatly reduced when nine papers are excluded, which makes ACCA more affordable.

- Worldwide Accreditation: ACCA is accepted in more than 180 nations, including Singapore, Canada, and Australia. This creates international employment options that would not be accessible with just a CA certification.

- Flexibility: The ACCA qualification can be earned at your own pace, possibly in as little as a year, thanks to the quarterly ACCA exam schedule.

How to Request Exemptions from ACCA

While it’s a simple process, applying for ACCA exemptions calls for close attention to detail. Take these actions:

- Find Out Which Exemptions Apply to You: To find out how many exemptions you qualify for depending on your CA qualification, use the ACCA Exemption Calculator on the ACCA website.

- Send in your Qualifications Proof: Provide ACCA with your official diplomas or transcripts of study. The awarding body’s stamp and signature are required on these documents.

- Fees for exemptions: Depending on how many exemptions you are claiming, there are different fees associated with each one. The exemption cost for nine papers, for professionals qualified by the CA, is about ₹13,500.

- Sign up: After completing your ACCA registration and receiving approval for your exemptions, you’ll be prepared to take the remaining exams.

Final Thoughts

ACCA exemptions provide a tremendous opportunity for CA-qualified professionals and students to accelerate their path to becoming internationally recognized chartered accountants. Taking advantage of these exemptions can help you expand your career opportunities abroad while also saving you time and money.

If you plan to apply for ACCA after CA, make sure you understand all of the requirements, including exemptions and costs. For individualized advice and assistance, get in touch with Saraf Academy. We can assist you with streamlining the exemption and registration process as an ACCA-certified learning partner, ensuring that you’re prepared for success on your ACCA journey.

FAQs

For any information, you can send us an email at classes@saraf.academy or contact us at +91 84440 40402.

Q1. How much does the ACCA exemption cost after CA?

For CA-qualified candidates, the exemption costs are roughly ₹13,500, and for CA Intermediate students, they are approximately ₹28,200.

Q2. After CA, how long does it take to finish ACCA?

If a professional with CA qualifications chooses to take quarterly tests and commits to regular study hours, they can finish ACCA in around a year.

Q3. Can someone with an unfinished CA seek an ACCA exemption?

Yes, if you passed CA Intermediate or scored 40 or above in specific areas like as Accounts, SFM, and Costing, you are eligible for exemptions.

Q4. How do my ACCA exemptions get calculated?

On the official ACCA website, you can verify your eligibility using the ACCA Exemption Calculator.

I am a qualified CA and want to peruse ACCA. I am currently working in Saudi Arabia. I want the help of Saraf Academy to continue the degree. Kindly let me know if it’s possible by me being away from India. Can you please tell me the breakups of the cost that will be needed for me to incur to complete the overall degree.

Thank you for contacting us! You can reach us at 8444040402/06 or email your detailed query to our official id: classes@saraf.academy. We will definitely assist you regarding the ACCA course.