What Is ACCA: Eligibility, Fees, Salary & Career Guide 2025 (The International CA Journey)

Discover ACCA in India 2025 – eligibility, exemptions, syllabus, fees in INR, salary scope, and ACCA vs CA. Build your global career with Saraf Academy.

A. What is ACCA? (International CA)

ACCA stands for Association of Chartered Certified Accountants. It is a UK-based professional body that teaches and certifies people in accounting, audit, tax, finance and business strategy. ACCA is recognised in 180+ countries and is built to give you practical skills (reporting, auditing, tax, management accounting and business strategy) that employers especially MNCs, Big 4 firms, GCCs and shared-service centres look for. If you study ACCA, you learn both the technical rules (IFRS / US GAAP awareness) and the professional skills (ethics, communication, decision-making) that help you get jobs in finance, audit, reporting, FP&A, risk and consulting. In today’s world of tough competition, ACCA opens doors to multiple job opportunities with attractive salary packages and most importantly, it makes you a true International CA.

B. Why ACCA in 2025

ACCA in 2025 is a strong choice because it gives global recognition, flexible exam options and modern, job-ready skills. Employers now expect people who can do financial reporting, data-led analysis and strategic thinking — ACCA’s updated syllabus and Strategic Professional papers focus on exactly these areas (analytics, sustainability and case-based judgement). Also, ACCA’s exam windows and computer-based options make it easier to study while working or doing internships. In short: if you want ACCA in India for global mobility, good employer demand and a career in audit, finance or shared-services, ACCA remains a practical and respected path in 2025.

C. ACCA Eligibility / ACCA after 12th

Route 1 – Foundation in Accountancy (FIA) route: There is no strict marks rule for 10th, 11th or 12th, even if you didn’t score well in Class 12 or you come from a non-commerce background, you can start ACCA via the FIA route. In FIA you take three foundation papers: FMA (Foundation Management Accounting), FFA (Foundation Financial Accounting) and FBT (Foundation Business & Technology). These cover the same core topics as MA, FA, BT in the main course – the ‘F’ just shows it’s the foundation level. Clear these three and you move straight into the ACCA skill level.

Route 2 – Direct entry route: If you have completed Class 12 with passes in at least 5 subjects (including English and Maths or Accounts) you can register directly for ACCA — this is the usual ACCA after 12th path. A common benchmark students follow is 65% in two subjects and over 50% in the rest, but the key point is you can start the knowledge level papers MA, FA, BT right away.

No matter which route you join from – FIA or Direct Entry, every student must clear a total of 13 ACCA papers to qualify. If you are eligible for exemptions, then you only need to pass the remaining papers after those exemptions.

Bottom line: ACCA is flexible – you can start from school or after graduation; the FIA “foundation” label only changes the name of the first three papers, not the career path.

Graduates (B.Com / B.Com Hons / M.Com) also join via direct entry and may get exemptions. B.Com (Hons) students whether in 1st, 2nd or 3rd year, and students who have completed a B.Com from a recognised university (for example, Calcutta University) commonly receive up to five paper exemptions. For other bachelor courses the exact number of ACCA exemptions varies by university and syllabus, so always verify using the official ACCA Exemptions Calculator.

✨ Inspiration: ACCA is so flexible that even young students have achieved great success. For example, Dishaan Shah cleared advanced ACCA papers while still in school, and Numair Khan from Bermuda passed his final exams at just 14 years old. Stories like these prove that with focus and determination, you can start your ACCA journey early and achieve big things.

| Entry Route | Minimum Requirement | Exemptions Available (Exemption means paper passed by not giving exam) |

| After Class 12 | 65% in Accounts/Maths + English, 50% in other subjects | No exemptions (must attempt all 13 papers) |

| Non-Commerce (Class 12) | No commerce background needed; can start with FIA (Foundation in Accountancy) | No exemptions |

| College Students (1st year/ 2nd year / 3rd year) | BCom Hons. from a recognized university (such as CU) | 5 Papers exemptions (BT, MA, FA, LW, TAX) |

| Graduates (Any Stream) | Bachelor’s degree in commerce or non-commerce | Commerce grads often get 4–5 exemptions (BT, MA, FA, LW, TAX) |

| CA Inter / CA Final | Completed CA Inter or Final | Up to 9 papers exempted (Applied Knowledge + Skills) |

| MBA / MCom | Postgraduate in commerce or business | 4–5 exemptions depending on curriculum |

D. ACCA structure & levels

ACCA is split into progressive levels so you build from basics to advanced professional judgement. You must pass the exams and complete the Ethics & Professional Skills Module (EPSM) . Below is the level / paper breakdown in simple form.

Levels & papers:

- Applied Knowledge (Knowledge level) basic foundation papers:

- BT — Business and Technology

- FA — Financial Accounting

- MA — Management Accounting

- Applied Skills (Skill level) core technical papers:

- LW — Corporate & Business Law (sometimes shown as CL/LW)

- PM — Performance Management

- TX — Taxation

- FR — Financial Reporting

- FM — Financial Management

- AA — Audit & Assurance

- Strategic Professional (Professional level) case & judgement papers:

- Compulsory: SBL – Strategic Business Leader; SBR – Strategic Business Reporting

- Options (choose 2): AFM (Advanced Financial Management), APM (Advanced Performance Management), ATX (Advanced Taxation), AAA (Advanced Audit & Assurance)

PER (36 months) is just like articleship in CA (simple): you must also gain 36 months of relevant work experience and complete/record 9 performance objectives that a qualified supervisor signs off. This is practical, on-the-job learning- similar in spirit to CA articleship but broader in types of roles (audit, FP&A, reporting, tax, internal controls).

E. ACCA paper pattern

(These are the typical/most common formats, ACCA sometimes varies pattern slightly by paper but this is what students usually face.)

Knowledge level (Applied Knowledge) : Short objective questions / OT tests, 2 hours, typically a set of objective questions (multiple choice / fill-in blanks / match the column) designed to test breadth of basics. This level is computer-based on demand.

Skill level (Applied Skills) : Mixed format, usually 3 sections across many papers:

Section A: Objective Test (OT) questions (15 OTQs = 30 marks)

Section B: OT case questions (case-based objective questions)

(example -: 5 OTQ from same question * 3 times = 30 marks)

Section C: Constructed response (written / long questions) making up the remaining ~40 marks (two long questions of 20 marks each).

This means you will see a mix of MCQs/objective items plus longer scenario-based written answers at Skill level. Note: certain Skill papers (like Audit & Assurance) have slightly different splits (like in audit paper there would be 30 marks MTQ and rest 70 marks theory)

Professional level (Strategic Professional) : Case-based, 100 marks, no single-line MCQs in the main paper. Papers like SBL and SBR are full-length, scenario-driven assessments that test professional judgement, communication and strategic thinking (you will write longer answers and board-room style case responses).

F. ACCA Fees in India

(at Sep 15, 2025 rates accaglobal.com.)

- Initial registration: One-time £89 / $121 / ₹10,660 (Often paid via your tutor or coaching package.)

- Annual subscription: £137/ $186 / ₹16,400 every year after joining ACCA. Must be paid each year to remain a student/member.

- Applied Knowledge exams: £120/ $163 / ₹12,000 per paper

3 papers in total-: £360 / $490 / ₹36,000. - Applied Skills exams: £147 / $200 / ₹17,600 per paper.

6 papers total -: £882 / $1,200 / ₹105,600. - Strategic Professional exams: £260 / $350 / ₹31,200 : 2 compulsory papers [SBR,SBL]

2 Options papers -: £185 / $250 / ₹22,200). [APM/ATX/AFM/AAA]

4 papers total -: £815 / $1,100 / ₹97,200). - Tuition (coaching) fees: $500–$700 per module – e.g. roughly ₹40000 (Knowledge), ₹75000 (Skills), ₹70000 (Professional) per level (varies by institute).

- Approximate total (exams + ACCA fees): Without coaching total fees-: £2,500 / $3,400 / ₹305,000). Including typical coaching total fees-: (£4,200 / $5,700 / ₹5,00,000).

G. ACCA Exemptions (specially BCom Students)

ACCA grants exemptions based on prior study.

However, students with relevant qualifications can skip exams: most Indian BCom graduates are eligible to skip the entire Applied Knowledge level and some Skills exams – typically 5 papers in total.

For example-: Students who have just joined college and are in their 1st , 2nd or 3rd year doing BCom from a recognised university such as CU then they will be granted 5 paper exemptions directly.

Crucially, qualified Indian CAs (after CA Final) get up to 9 paper exemptions (often moving directly into the Strategic Professional level), while CA Intermediate holders get about 5 exemptions. Exemption eligibility depends on your institution and syllabus; use the ACCA

If you are doing any other course then the final number of exemptions depends on your specific university, syllabus, and year of completion, so you must always verify using the official ACCA Exemptions Calculator.’ This manages expectations.

Click in this link to open acca exemptions calculator-: accaglobal.com.

H. Is ACCA Worth It?

Yes, especially for Gen Z finance professionals seeking global careers. ACCA’s modern syllabus (focused on IFRS, analytics, ethics, ESG and tech) matches international business needs. It is well-recognized worldwide (180+ countries) and valued by MNCs, Big 4 firms and global shared-services hubs.

In India, ACCA opens roles in audit, finance and consulting at both domestic firms and global captives. The flexible exam schedule (one paper at a time) lets you study alongside college or a job. While ACCA is rigorous, disciplined study (3 hrs/day) and support from good coaching (Saraf academy) can make it achievable. Overall, the ROI is strong for students targeting international standards and mobility, ACCA often boosts early-career salaries and access to top firms.

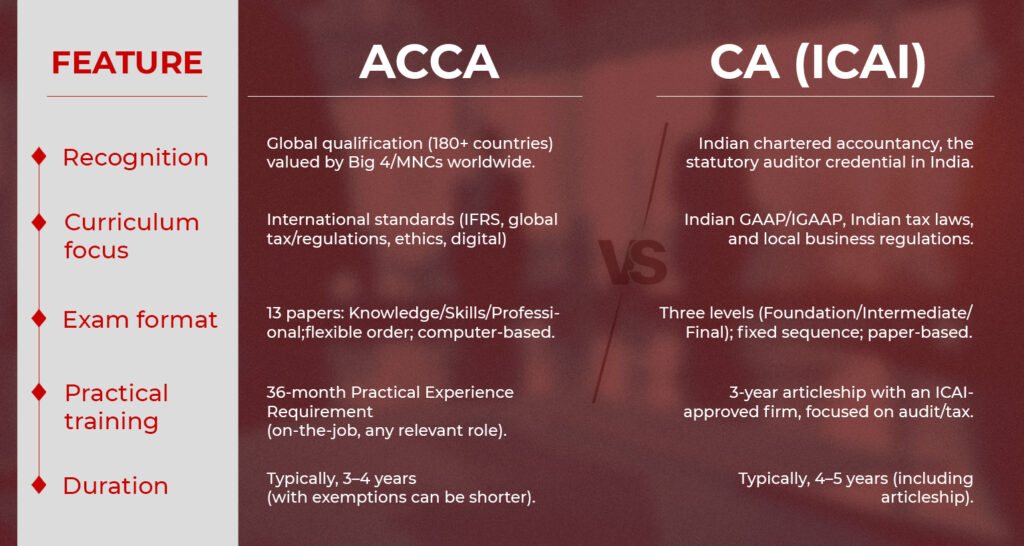

I. ACCA Vs CA in India

ACCA and the Indian CA (ICAI) qualification have different goals. ACCA is internationally focused (IFRS, global tax/business) vs CA’s India-centric (IGAAP, Indian tax law). ACCA allows modular study (any order, multiple sittings per year), whereas CA has fixed levels and a 3 year articleship. As a result, ACCA is generally faster (3–4 years) and more flexible; CA takes 4–5 years with mandatory work experience. ACCA covers broader finance roles (audit, reporting, analysis, advisory) with global mobility, while CA specializes in Indian statutory audit, taxation and compliance. In short, choose ACCA if you want a global finance career and flexibility; choose CA if you aim for deep expertise in Indian practice (audit, tax) and the prestige of ICAI membership.

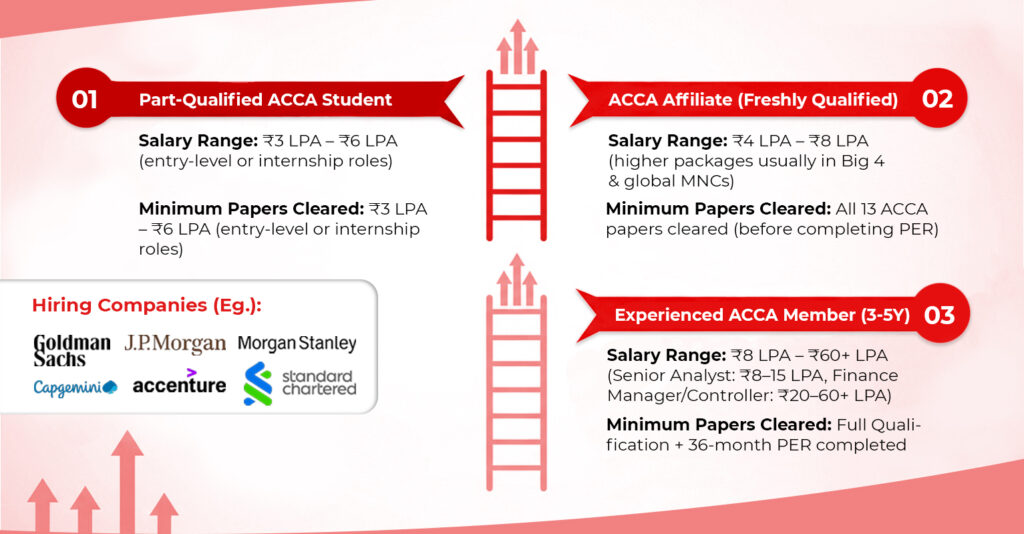

J. ACCA Salaries in India

In India, fresh ACCA affiliates typically start at ₹3–7 LPA, depending on city and sector. Smaller firms offer ₹3–6 LPA, while Big 4 or global-captive roles can begin around ₹6–8 LPA. Salaries rise with experience: mid-level (3–5 yrs) often see ₹8–15 LPA, and senior ACCAs (finance managers, controllers) can command ₹20–60+ LPA. Abroad, ACCA salaries are higher in absolute terms (e.g. £25–35k in UK, $50–60k in US for entry-level). Many top MNCs and Big 4 firms actively recruit ACCA students/affiliates (even before full qualification) because the IFRS skillset is in demand. Overall, ACCA-qualified professionals enjoy strong earning potential globally as well as in India.

K. Why Saraf Academy For ACCA

Saraf Academy is a leading ACCA coaching provider in India, known for affordable fees and experienced faculty. Prakash Saraf and team offer structured live classes, concise notes and frequent practice tests. Students appreciate the personalized doubt-clearing support (via phone/WhatsApp) and motivation from Saraf’s mentors. Reportedly, Saraf sir’s focus on conceptual clarity and exam strategy significantly boosts pass rates, many students see a >70% improvement in performance. For Gen Z learners on a budget, Saraf Academy combines low tuition with high “mentor horsepower”, making ACCA study less daunting. Their online format also helps students balance ACCA with college or work.

L. ACCA Pass Rates & Difficulty

ACCA is challenging but manageable with discipline. The syllabus is deep (especially at Professional level) and exams emphasize problem-solving and judgment. However, ACCA’s flexible exam structure (one paper at a time, multiple sessions per year) means you can pace yourself, unlike CA where many papers are taken together. Historically, pass rates hover around 40–80% depending on the paper (e.g. June 2025 Strategic exams ranged

40–51%). This reflects the tough scenario-based questions at higher levels. In practice, students who study consistently (even 2–3 hours daily) and do regular practice tend to clear exams on schedule. Many ACCA candidates juggle study with college or jobs and succeed by taking it one exam at a time. In short: ACCA requires steady effort and concept mastery, but with the right routine, it is certainly achievable.

M. Top ACCA Myths – Cleared

Myth 1: “ACCA has no value in India.”

Reality: Quite the opposite – ACCA is respected by MNCs, shared-service firms and Big 4 offices in India. Its global curriculum (IFRS, ethics, analytics) is in demand in sectors like finance, banking, consulting and tech hubs. ACCA’s global recognition means many Indian employers value the certification for international client work and multi-country operations.

Myth 2: “ACCA is only useful if I go abroad.”

Reality: ACCA graduates fill key roles domestically too. Indian companies (especially MNC subsidiaries, tech firms, BFSI and startups) actively hire ACCAs for audit, finance and advisory roles. Big 4 and major Indian firms recruit ACCA students/affiliates for their skillset. So, ACCA can lead to jobs in India’s metros just as much as overseas.

Myth 3: “ACCA is easier than CA.”

Reality: They’re simply different. ACCA’s global exams focus on IFRS and professional skills, whereas CA dives into Indian law and tax. ACCA allows flexible exam scheduling, but that doesn’t mean less hard work. Many find ACCA equally rigorous in its way (complex scenarios, extensive writing). Neither is a “walkover”, each demands dedication.

Myth 4: “Only commerce grads can do ACCA.”

Reality: ACCA is open to students from any stream. After 10th grade (any background), you just need basic marks (e.g. 65% in Maths/Accounts, 50% others) to start. Even science or arts students can join ACCA via the Foundations route. ACCA focuses on what you learn after joining, not what you studied in high school.

Myth 5: “ACCA doesn’t lead to good jobs.”

Reality: False. ACCA opens many finance careers. ACCAs work as auditors, analysts, consultants, controllers, CFOs, etc. Global companies and Big 4 actively recruit them. Entry salaries in India (₹3–7 LPA) quickly rise with experience. In many cases, ACCA affiliates land jobs even before full qualification, thanks to the certification’s reputation.

Myth 6: “ACCA isn’t updated/relevant.”

Reality: ACCA regularly updates its syllabus to match business trends. Recent changes include new IFRS standards, data analytics and sustainability topics. The ACCA Qualification is designed to be modern and in sync with industry, so your skills stay current.