What Is CMA US Course? What Is The Duration Of CMA Course? CMA US Course Fees | CMA US Course Syllabus | CMA US Job Opportunities in 2025

CMA US: Your fast track to practical finance skills

CMA US (Certified Management Accountant, USA) is a professional qualification focused on management accounting, strategic finance, and business decision-making. Unlike old-style theory-heavy courses, CMA US teaches you how to use numbers to solve real business problems – pricing, budgeting, forecasting, valuation, risk, and strategic decisions.

Why this matters (Prakash Sir’s point): The world is moving from “number crunching” to data sense + business advising. He stresses that CMA US is practical and case-based, not just formulas you memorise – so students learn to explain why a variance happened and recommend actions to fix it. That makes CMA US a toolkit for tomorrow’s CFOs and business leaders.

Quick takeaways

- Global course, highly practical, taught with case studies and real-world examples.

- Ideal if you want to move beyond bookkeeping into FP&A, strategy, M&A, or

CFO-track roles.

Flexible for students who study alongside college or jobs – Many students clear CMA US within 1 year with steady effort.

1) What is CMA US?

Full form: Certified Management Accountant (CMA) – awarded by the Institute of Management Accountants (IMA), USA.

Core focus: Financial planning, performance & analytics (Part 1) and Strategic financial management (Part 2). Each part tests your ability to apply finance as a business tool, not only to compute numbers.

Key features :

- Two-part exam (Part 1 + Part 2), each 500 marks, practical-case heavy.

- Exam format: Mostly MCQs + case/essay questions (100 MCQs + case-based items per paper). Passing bar is high (Average Score: 360/500).

- Global recognition: Taught/used in many countries and by GCC/Big-4/MNCs — makes you internationally employable.

- Practical learning: Focus on why something happened (variance), what it implies, and how to fix it — not just formulas.

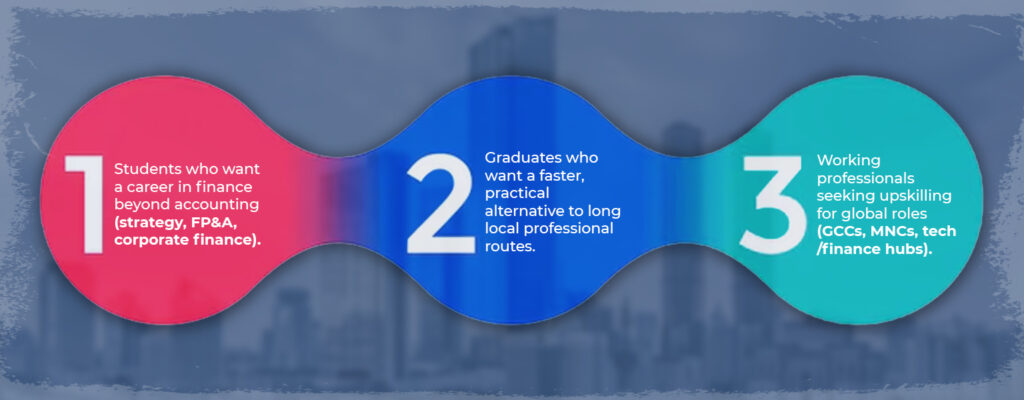

2) Who should do CMA US?

3) Why CMA US in 2025?

Prakash Sir repeatedly explains that global business needs are shifting – AI, data analytics, ESG and sustainability, and integrated reporting are changing finance jobs. CMA US prepares you for these future needs. Below is a clean list of WHY CMA US is the smart pick in 2025.

Top 8 reasons :

- Practical + case-based syllabus — learn how to apply finance in business problems (Prakash Sir always says : “you will never forget if I involve you in the story”).

- Fast & focused — just two papers to pass; serious students can finish in 8–12 months with 2–3 hrs/day of study

- High ROI — lower cost and faster completion than many local professional options; international job doors open.

- Global demand — GCCs, Big 4, MNCs and tech firms in India hire CMAs for FP&A, treasury, and strategic roles.

- Future-ready skills — emphasis on analytics, forecasting, ESG and strategic decision-making that AI & automation won’t replace.

- Flexible exam windows — multiple exam windows in a year so you can plan around college or work.

- Career versatility — works for corporate jobs, consulting, in-house finance, or even running your own advisory/consulting projects.

- Accessible from early — you can start studying during graduation and finish early to enter the job market with a strong edge.

| Factor | CMA US | Typical Indian professional (e.g., CA / local CMA) |

| Time to complete (serious student) |

~8–12 months | 4–5+ years (including articleship/practice) |

| Focus | Practical, case-based, strategic | Depth in statutes, longer practical training |

| Global mobility | High (IFRS, global finance skills) | More India-centric (though valued locally) |

| Exam frequency | Multiple windows/year (flexible) | Less frequent (fixed windows) |

| Cost (typical) | Lower overall (exam + coaching) | Often higher when factoring articleship / tuition |

As said earlier, Prakash sir always says that : “If you want to be a business adviser, not just a number-cruncher, CMA US teaches the practical skills you’ll actually use in boardrooms and GCCs. It’s a toolkit for tomorrow’s CFO.”

CMA US is a fast, practical, globally-relevant finance qualification that turns students into strategic business advisors — perfect for Gen-Z learners who want meaningful, future-proof finance careers.

4) CMA US Course Structure & Syllabus

The CMA US exam has two parts – each designed to test practical business finance skills. Both papers are case-heavy, ensuring you learn how to apply concepts in real corporate situations rather than just memorise formulas.

Part 1: Financial Planning, Performance & Analytics

This paper builds your foundation in how businesses plan, monitor, and analyse performance. Topics include:

- Budgeting & Forecasting – planning future financials.

- Cost Management – analysing costs and controlling expenses.

- Performance Management – measuring results against goals, variance analysis.

- Internal Controls – ensuring accuracy, compliance, and fraud prevention.

Example from Sir: Variance analysis is not just “number went up or down”; CMA teaches you to explain why it happened and what action management should take.

Part 2: Strategic Financial Management

This paper moves to advanced topics where finance meets strategy. Topics include:

- Corporate Finance – raising, managing, and allocating capital.

- Financial Statement Analysis (FSA) – interpreting numbers into insights.

- Investment Decisions – capital budgeting, NPV, IRR, M&A evaluations.

- Risk Management – hedging, managing uncertainty in financial decisions.

Why the syllabus stands out?

- Case-based, business-focused — you become a problem solver, not just an accountant.

- Aligned with global business practices and IFRS.

- Practical — highly valued by GCCs, Big 4, and MNCs in India & abroad.

5) Eligibility for CMA US

One of the most student-friendly parts of CMA US is its flexible entry routes. Here’s how it works:

- Start learning right after Class 12:

Students in India can begin coaching for CMA US alongside graduation. Many students in 11th or 12th standard have already started, showing how early you can step in. - Official IMA requirement for certification:

- A bachelor’s degree in any stream (Commerce, Arts, Science, Engineering, etc.).

- Two years of relevant work experience in finance, accounting, or management.

- These can be completed alongside or after exams.

- During graduation:

You can register as a student member with IMA, attempt both exams, and complete certification once your degree + 2 years’ work are done.

In short: You can start CMA US as early as Class 12, but certification comes after graduation + 2 years’ work experience.

6) CMA US Exam Pattern & Passing Marks

CMA US exams are designed to test both knowledge and application. Each part has a clear structure:

- Duration: 4 hours per exam.

- Format:

- 100 MCQs (3 hours) → mix of theory, calculations, and applied questions.

- 2 Essay/Case Studies (1 hour) → scenario-based, you explain analysis and recommendations.

- Scoring:

- Total marks: 500.

- Passing score: 360/500 (i.e. 72%).

- No sectional cut-off: performance is judged overall, not separately in MCQs or essays.

Why this matters?

- You don’t just tick MCQs – essay questions test whether you can think like a manager.

- Passing standard (72%) is high, which is why CMA US has strong global credibility.

7) CMA US Duration & Study Plan

One of the best things about CMA US is how fast and flexible it is compared to other courses.

- Typical Duration:

Most students complete CMA US in 8 – 12 months if they study 2 – 3 hours daily. Prakash Sir often says that with discipline, you can finish both parts within a year, even alongside graduation or work. - Class + Self-Study Model:

- Live classes twice a week at Saraf Academy.

- Rest of the week → self-study (2 – 3 hours/day).

- Balance ensures doubts get solved immediately while also building independent learning habits.

- Exam Windows:

Exams are held in three flexible windows each year:- Jan – Feb

- May – Jun

- Sep – Oct

This gives students six months of opportunities to schedule exams as per readiness.

In short: CMA US can be cleared much faster than Indian CA/CMA — no need to wait for 4–5 years.

8) CMA US Fees in 2025

CMA US is one of the most affordable international finance qualifications in India, especially with discounts through Saraf Academy.

Fee Components (approx 2025 figures)

- IMA Membership Fee – one-time + annual renewal.

- Entrance Fee – paid once when registering for the course.

- Exam Fee (Part 1 + Part 2) – payable when booking each paper.

With Saraf Academy discounts, total fees are approx :

- Students: ₹1.2 – 1.4 lakh.

- Professionals: ₹1.6 – 1.8 lakh.

(These include IMA fees + exam fees. Tuition fees at Saraf Academy are additional but highly subsidized compared to competitors.)

| Course | Duration | Cost in India | Global Recognition |

| CMA US | 1 year | ₹1.2 – 1.8 lakh | Global |

| CA India | 4 – 5 years | ₹3 – 4 lakh | India-focused |

| CMA India | 3 – 4 years | ₹2 – 3 lakh | India-focused |

| MBA (Tier-1) | 2 years | ₹15 – 25 lakh | World/India Depends on college |

This makes CMA US the cheapest and fastest global course in finance.

9) Career Opportunities & Salaries

CMA US is a career accelerator that prepares you for high-demand roles across India and abroad.

- Popular Job Roles:

- Financial Planning & Analysis (FP&A)

- Risk & Compliance Analyst

- Internal Audit / Control Specialist

- Finance Manager

- Senior Analyst

- Pathway to CFO / Leadership roles

- Salary in India (2025):

- Freshers: ₹5 – ₹8 LPA (Big 4 + MNCs).

- Mid-level (3–5 years exp): ₹12 – ₹20 LPA.

- Senior roles: ₹25 LPA+ (Finance Controller, CFO track).

- Salary Abroad (US/Canada/Middle East):

- 3 – 4x India salary levels.

- Example: A fresher can earn 60,000 $ + annually in the US.

- Hiring Companies:

- India: Accenture, Deloitte, EY, KPMG, TCS, Infosys, Reliance.

- Abroad: Amazon, Apple, Boeing, Emirates, Walmart, PwC, JP Morgan.

As per Prakash Sir’s experience -: Companies are not just open to CMA US, they are actively searching for CMA US-qualified candidates.

Student Success Story

Aditi Sharma, a B.Com (Hons) student who joined CMA US with Saraf Academy while still in college.

- She followed the 8 – 12 months study plan (2 – 3 hours daily + live classes twice a week).

- Cleared both parts of CMA US in just 11 months, alongside her graduation.

- Within 2 months of completing the course, she landed a role at Deloitte (Gurugram) with a starting package of ₹7.5 LPA.

Aditi’s journey shows how CMA US can open Big 4 opportunities early, even before completing a master’s or waiting for years like in CA/CMA India.

10. CMA US vs Indian CA/CMA

When students in India think of professional finance courses, the first names that come up are CA (Chartered Accountancy) and CMA (Cost & Management Accountancy). These are excellent courses but are longer in duration and more India-focused, whereas CMA US offers global recognition and quicker completion. With only 2 papers, CMA US can be completed in 8–12 months, while CA and CMA India typically take 4–5 years.

Comparison Table: CMA US vs CA vs CMA India

| Feature | CMA US | CA (India) | CMA (India) |

| Exam Structure | 2 papers (MCQ + Essay) | 3 levels, 16 – 20 papers | 3 levels, 20 papers |

| Duration | 8 – 12 months (with 2–3 hrs daily study) |

4 – 5 years | 3 – 4 years |

| Recognition | Global (170+ countries) | India-centric | India-centric |

| Focus Areas | FP&A, Risk, Corporate Finance, Strategy | Audit, Tax, Indian Law | Costing, Indian Regulations |

| Flexibility | 3 exam windows/year (Jan-Feb, May-Jun, Sep-Oct) |

2 attempts/year | 2 attempts/year |

| Job Roles | MNCs, Big 4, GCCs, CFO track | CA Firms, Audit, Taxation | Cost Audit, Corporate Finance (India) |

| Average Fresher Salary (India) | ₹5 – 8 LPA | ₹6 – 9 LPA | ₹4 – 7 LPA |

11. Why Saraf Academy for CMA US?

If you’re serious about CMA US, your choice of institute will decide your success. At Saraf Academy, we’ve trained 2,00,000 + students globally and have been a Gold Learning Partner for decades. But what makes us different?

- Live Classes – The Game Changer: As students themselves say, “The biggest turning point was attending LIVE classes with doubt solving like a mentor and big brother.”

- Exclusive Discounts: Get up to 45% on membership & entrance fees and 35% on exam fees through Saraf Academy’s IMA partnership.

- Strong Mentorship: Immediate support, repeated doubt-solving, and guidance on how to balance work/study.

- Proven Track Record: Students placed in Big 4, MNCs, and GCCs with strong alumni support.

- Affordable Fees: Among the lowest tuition fees in India with the highest success rates (pass probability rises by 70% with Saraf coaching).

If you want not just coaching but personal mentoring + placements, Saraf Academy is the best CMA US institute in India.

12. CMA US Pass Rates & Difficulty

CMA US is not an easy exam, but it is much more flexible than Indian alternatives. Since there are only 2 papers, you don’t have to struggle with multiple levels or 20+ exams.

- Global Pass Rates: On average, 50% worldwide.

- Achievability: With 2 – 3 hours of consistent daily study + Saraf Academy’s live classes, students clear both parts in 8 – 12 months.

- Balanced Exam Style: Mix of MCQs and essays, focusing on application & analysis instead of rote learning.

- Student Experience: Even school students and working professionals manage CMA US alongside classes or jobs.

In short, CMA US is tough but very doable, provided you stay consistent. With Saraf Academy’s structured plan, passing within a year is realistic.

Many students in India hesitate about CMA US because of common misconceptions. Let’s clear them up one by one:

- “CMA US has no value in India.” – Wrong Right – Big 4 firms (Deloitte, PwC, EY, KPMG), MNCs (Amazon, Accenture, Capgemini), and GCCs actively hire CMA US professionals in India.

- “It’s only for working abroad.” – Not true

Right – While CMA US is globally recognized, the demand in India’s financial hubs like Bangalore, Hyderabad, Pune, and Gurgaon is growing rapidly. - “It’s easier than CA.” – Misleading Right – CMA US has just 2 papers compared to CA’s 20+, but the exam is case-based, analytical, and business-oriented. It requires application skills, not rote learning.

- “An MBA is enough.” – Not true

Right – CMA US is more specialized in finance, FP&A, and strategy. MBA is broader, while CMA US gives in-depth financial expertise valued by CFO-track roles. - “It won’t help freshers.” – Wrong

Right – Even part-qualified CMA US students get ₹4–6 LPA internships or fresher jobs in India. Abroad, salaries can be 3–4x higher.

14. FAQs Students Ask (2025 Edition)

The most common CMA US FAQs answered simply and clearly for students in India:

Q1. Is CMA US worth it in India in 2025?

Yes. It is highly valued by MNCs, Big 4, and GCCs. Students aiming for global finance roles find it more rewarding than local-only courses.

Q2. How much does CMA US cost in India?

Around ₹1.2 – ₹1.8 lakhs including registration, membership, and exam fees (with Saraf Academy discounts). This makes it one of the most affordable global qualifications.

Q3. Can I do CMA US after 12th?

Yes. You can register as a CMA US student after 12th. Official certification requires a bachelor’s degree + 2 years’ work experience, but exams can be cleared during graduation.

Q4. CMA US vs CA – which is better?

CMA US is better for global recognition, quicker completion (8 – 12 months), and FP&A/strategic roles. CA is better for Indian taxation, law, and statutory audit.

Q5. How long does it take to pass CMA US?

With consistent 2 – 3 hours/day, students pass in 8 – 12 months. Flexibility of exam windows makes it easier to plan.