An Enrolled Agent (EA) is a tax professional authorized by the U.S. Department of the Treasury to represent taxpayers before the Internal Revenue Service (IRS).

Becoming an EA is a great career choice for students who have an interest in taxation, as it offers excellent job opportunities, a good salary, and professional growth.

This guide will explain the steps to become an Enrolled Agent in a simple and easy-to-follow way.

Step 1: Understand the Role of an Enrolled Agent

An Enrolled Agent (EA) is a tax expert who specializes in tax preparation, tax planning, and IRS representation. Unlike Certified Public Accountants (CPAs) or tax attorneys, EAs focus only on tax laws and have unlimited rights to represent any taxpayer before the IRS.

Step 2: Meet the Basic Requirements

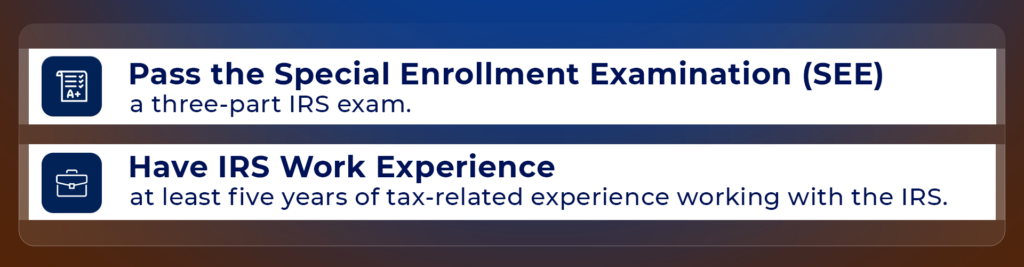

The best part about becoming an EA is that there are no specific educational requirements. You don’t need a college degree or prior work experience. Anyone with a strong interest in taxation can apply. However, you must meet one of these conditions:

- Pass the Special Enrollment Examination (SEE) – a three-part IRS exam.

- Have IRS Work Experience – at least five years of tax-related experience working with the IRS.

Step 3: Prepare for the Special Enrollment Examination (SEE)

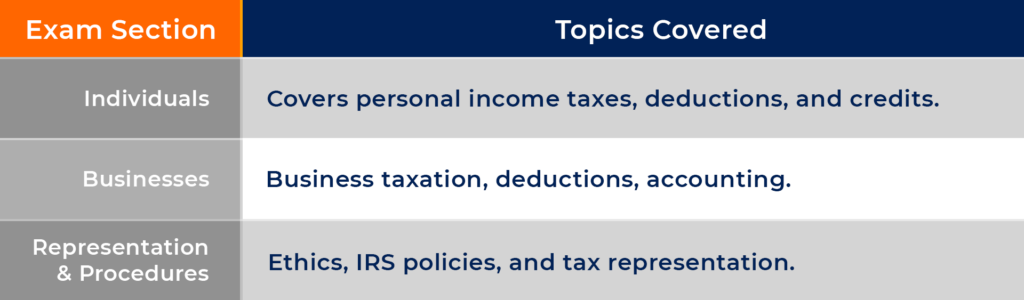

The SEE Exam consists of three parts:

- Individuals – Covers personal income taxes, deductions, and credits.

- Businesses – Focuses on business tax returns, deductions, and accounting methods.

- Representation, Practices, and Procedures – Tests your knowledge of IRS procedures, ethics, and taxpayer representation.

Tips to prepare for the Enrolled Agent Exam:

- Use IRS-approved study materials.

- Enroll in EA preparation courses.

- Take practice tests to familiarize yourself with the exam format.

If you’re looking for expert guidance, you can get EA training at Saraf Academy, where they provide comprehensive coaching and resources to help you succeed.

Step 4: Register and Take the SEE Exam

- Create an account on the Prometric website (the official testing provider for the IRS).

- Schedule your exam at a nearby test center.

- Take and pass all three parts of the SEE exam within a two-year period.

Step 5: Apply for Enrollment

Once you pass all three parts of the exam, you must:

- Submit Form 23 to the IRS (Application for Enrollment).

- Pay the required fee.

- Undergo a background check to verify your tax compliance history.

Step 6: Maintain Your EA Status

After becoming an Enrolled Agent, you must:

- Complete 72 hours of continuing education every three years.

- Follow IRS rules and ethics to keep your license active.

Career Opportunities for Enrolled Agents

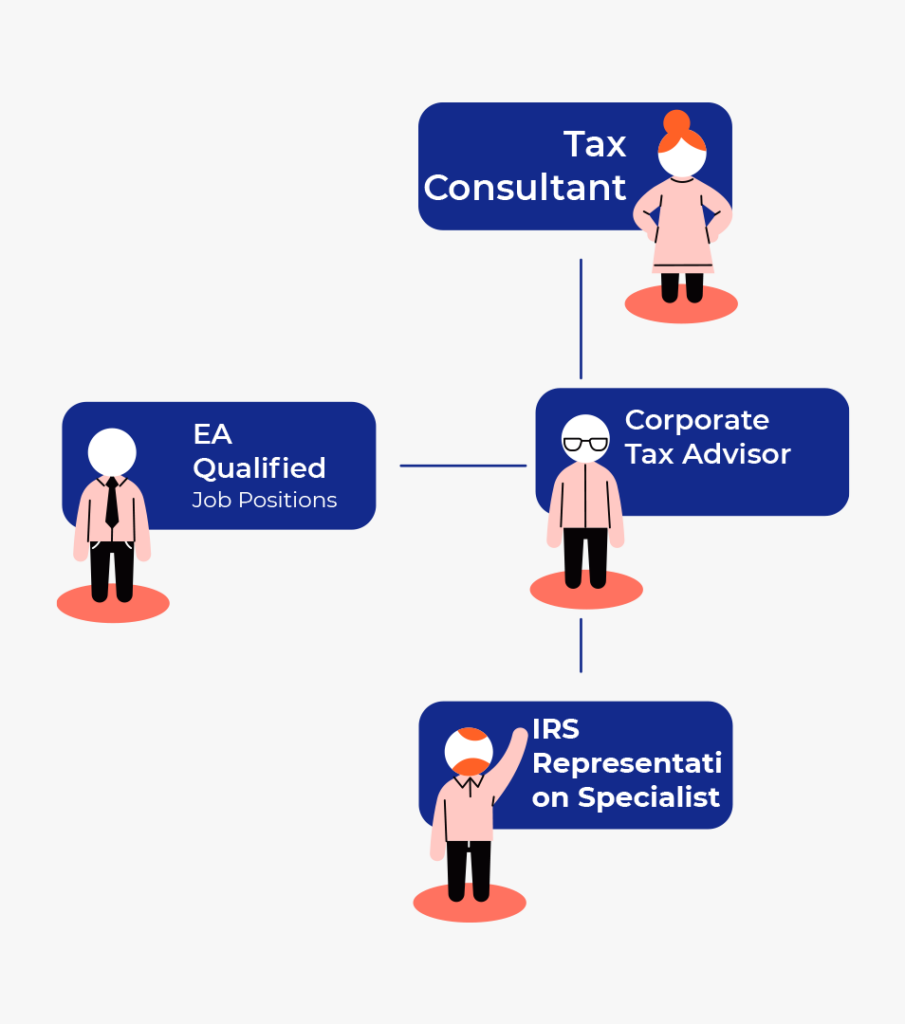

Once certified, you can work in various fields such as:

- Tax Consultant – Helping individuals and businesses with tax planning.

- IRS Representation Specialist – Assisting clients with audits and disputes.

- Corporate Tax Advisor – Working with businesses to ensure tax compliance.

Self-Employed Tax Practitioner – Running your own tax preparation business.

Conclusion

Becoming an Enrolled Agent is a straightforward and rewarding career path for students interested in taxation. With no degree requirement and high earning potential, it provides excellent opportunities in the tax industry.

By following these simple steps—preparing for and passing the SEE exam, applying for enrollment, and maintaining your credentials—you can start a successful career as an EA. If you enjoy working with numbers and tax laws, this profession is a great choice for you!

If you’re looking for the right place to start your journey as an Enrolled Agent, Saraf Academy offers top-notch training and tuition to help you succeed.

Our expert instructors provide comprehensive coaching, study materials, and exam guidance to ensure you are fully prepared for the SEE exam.