CPA Exam 2026 Eligibility, Costs & Career Success: Your Complete Step-by-Step Guide

1. Introduction: Is a Global Qualification Like CPA US Right for You?

For ambitious finance professionals in India, one of the biggest career questions is: should I pursue an Indian qualification or an international one? The CPA US course stands out as a premier global option, but it’s essential to begin with an honest perspective.

Many believe that international courses are an easier path. However, as an educator with over 30 years of experience, Prakash Saraf is quick to correct this myth.

“Do we want to say that international courses are easier to crack? No. Not a single international course which is recognized is easier than Indian CA… to pass. Don’t think like that.”

The real advantage of international courses like the CPA US isn’t about easier content; it’s about a smarter, more flexible structure designed for the modern professional. Here’s what sets it apart:

- Flexibility for Working Professionals: Unlike the rigid group system of Indian qualifications, the CPA allows you to appear for one paper at a time. This means you can focus your energy on mastering a single subject while balancing a full-time job and other responsibilities.

- A Practical, Engaging Approach: The curriculum is designed to be more practical and less about rote memorization. The focus is on applying concepts to real-world business scenarios, which, as Prakash Sir notes, makes the study process “more interesting.”

- Frequent Exam Windows: If you don’t pass a paper, you don’t have to wait six months for the next attempt. Exams are held frequently throughout the year, so you can re-appear quickly, saving precious time and maintaining your momentum.

The CPA US isn’t an easy shortcut, but it is a flexible and highly practical pathway for dedicated professionals aiming for a globally recognized credential.

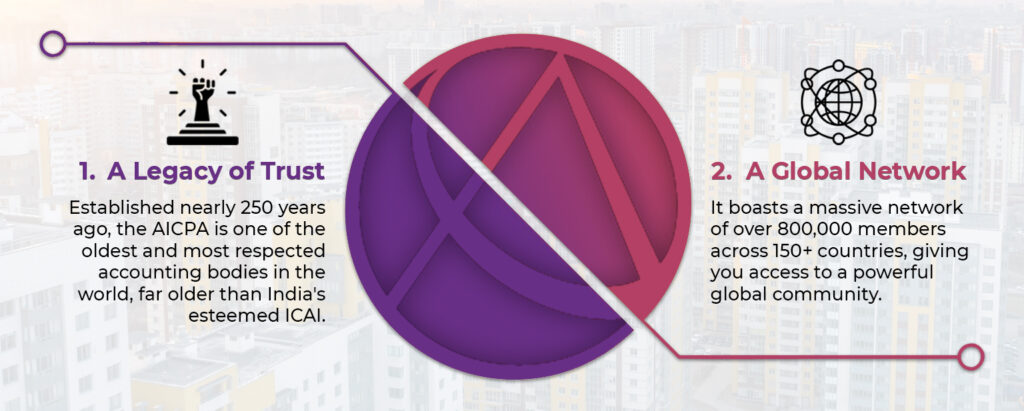

2. Why CPA US? The Power of a “Global Passport” from a 250-Year-Old Body

What gives the US CPA designation its immense power and prestige? The answer lies in the unparalleled legacy of its governing body and the global influence of the US economy.

The CPA US license is awarded by the AICPA (American Institute of Certified Public Accountants), an institution with a formidable history.

Prakash Sir frames the value perfectly by connecting it to the US’s role as a global “superpower.”

“US companies have their business all over the world… So US companies want CPA certified persons because in the course they are teaching US tax, US laws, US regulations.”

Because US business practices – including US GAAP, Auditing Standards, and Tax Laws – are the benchmark for many global corporations, holding a CPA license makes you fluent in the language of international business. It acts as your “global passport,” unlocking opportunities not just in the United States, but with the thousands of US-based multinational corporations and Global Capability Centres (GCCs) operating right here in India.

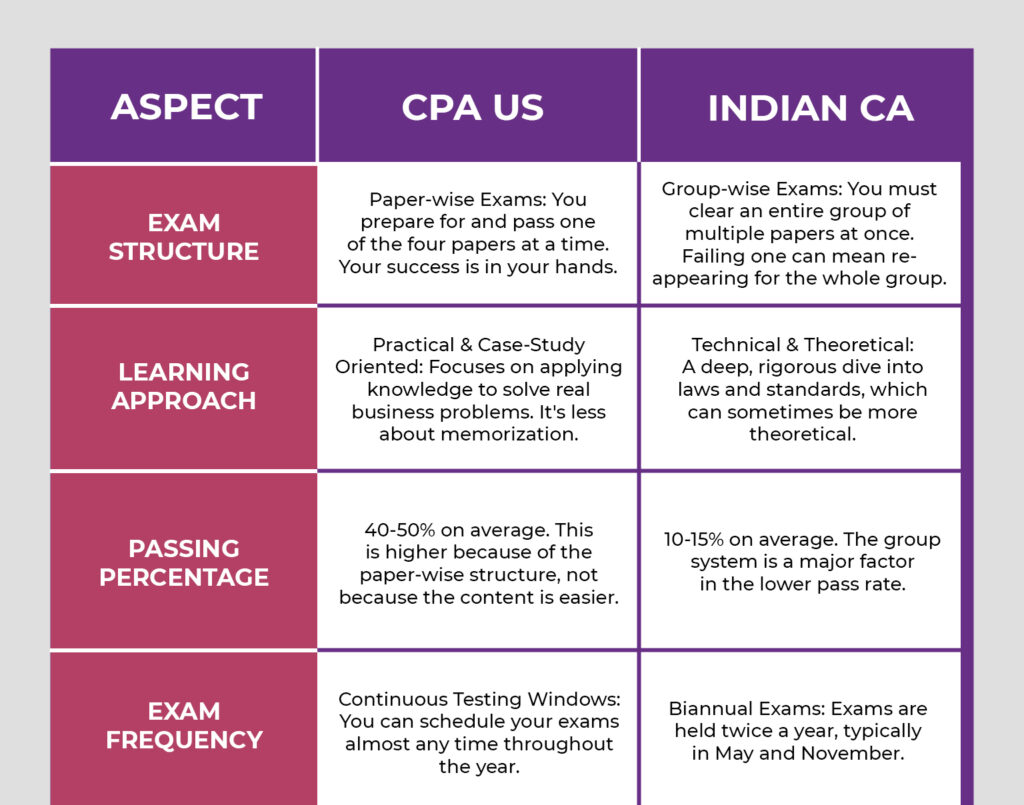

3. CPA US vs. Indian CA: A Practical Comparison for Indian Students

For many finance aspirants in India, the ultimate question is: CPA vs. Indian CA? Both are excellent qualifications, but they are built on fundamentally different philosophies of learning and examination. Understanding these differences is key to choosing the right path for your career goals.

Based on Prakash Sir’s experience teaching both Indian and international courses, here is a practical comparison:

The Key Takeaway: The content and rigor of both qualifications are high. However, the CPA exam pattern offers a level of flexibility and practical focus that is ideally suited for working professionals who need to balance their studies with a demanding career. It allows you to progress at your own pace without the high-stakes pressure of an all-or-nothing group system.

4. The CPA Eligibility Maze: Unlocking the 120 Credit Hour Rule for Indians

One of the most significant hurdles for Indian aspirants is meeting the strict CPA US eligibility criteria. As Prakash Sir states, this is a “no free entry course.” You must fulfill specific educational requirements before you can even sit for the exams. Let’s break down the biggest component: the 120 credit hour rule.

In the US system, one year of Indian university education is typically evaluated as 30 credit hours.

- A standard 3-year B.Com degree = 90 credit hours.

- A 4-year B.Com (under the New Education Policy) = 120 credit hours.

This means that if you hold a 3-year bachelor’s degree, you fall short of the 120 credits required to appear for the exam. But don’t worry there is a clear path forward.

How to Bridge the 30-Credit Gap

Here are the most common pathways for Indian students to meet the 120 credit hour requirement:

Navigating which state to apply through and getting your credentials evaluated is a complex process. At Saraf Academy, we provide expert, end-to-end guidance to ensure you find the most efficient and cost-effective path to eligibility.

5. Decoding the Investment: A Transparent Breakdown of CPA US Fees in India

The CPA US is a premium qualification, and it’s important to be honest about the investment required. As Prakash Sir puts it, the CPA is a “good costly course.” A clear understanding of the costs helps you plan your journey effectively.

The total CPA US fees in India will be approximately ₹4 Lakhs, spread over 12 to 18 months. This is not a single payment but a combination of fees paid to US bodies and your preparation providers.

Here is a transparent breakdown of the total estimated investment:

| Component | Paid To | Approx. Cost (USD) | Approx. Cost (INR) |

| Institute & Exam Fees | AICPA / NASBA / State Boards | $3,400 | ₹2.9 Lakhs |

| Certified Study Materials | Gleim (Saraf Academy’s Partner) | $600 | ₹50,000 |

| Expert Training & Coaching | Saraf Academy | $600 | ₹50,000 |

| Total Estimated Investment | $4506 | ₹4 Lakhs |

*Note: Institute and exam fees are paid in US Dollars ($). The Indian Rupee (₹) amount is an approximation based on current exchange rates and is subject to change.

Flexible Payment Options

We understand that this is a significant investment. To make it more manageable, Saraf Academy offers a no-cost EMI facility for our portion of the fees (Training + Materials). This allows you to spread the cost over six months without any interest burden, so you can focus on what truly matters your studies.

6. Cracking the CPA Exam: A Realistic 18-Month Plan for Working Professionals

The next big question is: Is the CPA exam difficult? Prakash Sir gives a direct and honest answer: yes. He cautions students against a common misconception:

“The common notion in the students [is] multiple choice… multiple choice is the most difficult exam in the world. So US CPA exams are very difficult because they are entirely multiple-choice based and [the] pass mark [is] around 75% out of 100. It’s not easy to crack.”

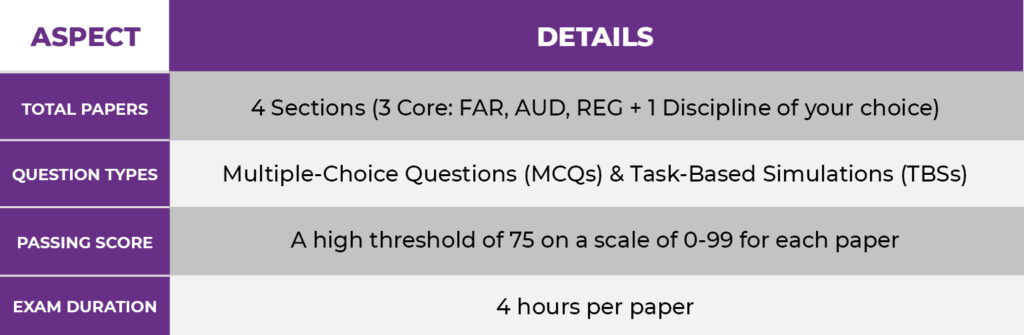

Success on the CPA exam requires deep conceptual knowledge, not just memorization.Understanding the Exam Format

A Proven Strategy for Success

While the exam is tough, it is absolutely achievable for working professionals with the right strategy. The key isn’t to study more; it’s to study smarter and more consistently.

- The 2-Hour Daily Formula: The cornerstone of success is committing to two to two-and-a-half hours of regular, focused study every day. As Prakash Sir notes, this consistent effort is far more effective than trying to cram on weekends.

- The 18-Month Timeline: While it’s possible to finish in 12 months, the vast majority of working professionals take an average of 18 months to comfortably prepare for and pass all four sections. This realistic timeline allows for deep learning without causing burnout.

The CPA journey is a marathon, not a sprint. With the right discipline and expert guidance, you can confidently cross the finish line.

7. Career & Salary After CPA US: Unlocking Six-Figure & Freelance Opportunities

A premier qualification like the CPA US isn’t just an academic achievement; it’s a direct investment in a high-growth, high-income career. The opportunities for CPAs, both in India and globally, are expanding at an unprecedented rate.

The Rise of Global Capability Centers (GCCs) in India

One of the biggest drivers of CPA jobs in India is the explosion of GCCs. As Prakash Sir highlights:

“We have already in India 1200 plus global capability centers… they are basically the back office of US, UK, [and] so many countries’ companies… for service purpose.”

These GCCs of giants like Amazon, Morgan Stanley, and thousands of other US corporations need professionals who are fluent in US GAAP, US Auditing Standards, and US Tax Law. This has created a massive, high-paying job market for CPAs right here in India.

The Lucrative World of Freelancing

The CPA license is also your key to becoming a location-independent professional. With a global shortage of US tax and accounting experts, a huge market for freelance work has opened up.

- High Hourly Rates: As Prakash Sir notes from his experience with students, freelancers can start by earning $20-$30 per hour. Once you prove your worth, this can quickly climb to $50, even $80 per hour.

- Ultimate Flexibility: You can work from anywhere in India, serving clients in the US and earning in dollars. The CPA license gives you the credibility to build your own practice without being employed anywhere.

CPA Salary in India: A Realistic Look

The CPA salary in India is among the highest in the finance and accounting profession, reflecting the specialized skills and global demand.

| Experience Level | Typical Role | Estimated Annual Salary (INR) |

| Fresher / Entry-Level | Associate at Big Four, Financial Analyst at MNC | ₹7 Lakhs – ₹10 Lakhs |

| Experienced (2-5 years) | Senior Associate, FP&A Analyst, Internal Auditor | ₹12 Lakhs – ₹20 Lakhs |

| Senior Level (5+ years) | Manager/Director at Big Four/MNC, Controller | ₹25 Lakhs+ |

8. CPA Exam Syllabus & Structure [2025 Evolution]

The CPA exam is a rigorous test of your knowledge. In 2025, the exam evolved into a “Core + Discipline” model to better reflect the skills modern accountants need. Understanding this structure is the first step in your preparation.

The CPA exam pattern consists of four sections: three compulsory Core sections and one Discipline section of your choice.

The Core Sections (Compulsory for All)

- FAR (Financial Accounting and Reporting): The most comprehensive section, this covers the depths of US GAAP and IFRS, focusing on how to prepare and analyze financial statements for various entities.

- AUD (Auditing and Attestation): This section tests your knowledge of US Auditing Standards, ethics, and the procedures for conducting audits and other attestation engagements.

- REG (Regulation): As Prakash Sir notes, this is a critical paper covering US Federal Taxation (for individuals and businesses) and US Business Law.

The Discipline Sections (Choose One)

This is where you can specialize based on your career interests.

- BAR (Business Analysis and Reporting): An advanced version of FAR, this is ideal for those who want to work in complex financial reporting roles, technical accounting, or for public companies.

- TCP (Tax Compliance and Planning): A deep dive into advanced personal and corporate tax planning. This is the perfect choice for aspiring US tax specialists.

- ISC (Information Systems and Controls): This track focuses on IT audit, data security, and information systems, ideal for those interested in the intersection of technology and accounting.

As Prakash Sir mentions, most students typically choose either BAR for a career in corporate finance or TCP for a specialization in taxation.

9. The Saraf Academy Advantage: Your Partner from Eligibility to Licensing

A journey as complex and demanding as the CPA US requires more than just study material; it requires a dedicated partner who can guide you through every hurdle. At Saraf Academy, we provide the end-to-end support system designed for the success of Indian professionals.

Here’s why Saraf Academy is the best CPA coaching in India:

- We Solve Your Biggest Problem – Eligibility: Navigating the 120-credit rule, getting your credentials evaluated, and choosing the right US state board is the most confusing part of the process. We manage this entire process for you, ensuring a smooth and successful registration.

- Structured Live Classes for Professionals: Our CPA online classes are not pre-recorded lectures. They are live, interactive sessions held at convenient times for working professionals (e.g., Friday evenings and Sunday mornings), allowing you to learn effectively without sacrificing your job.

- Expert Faculty and Full Support: While our expert faculty, Mr. Samarth Bhatia, leads the CPA classes, you get the full support of the entire Saraf Academy ecosystem. As Prakash Sir assures, “My indirect interference and all support will be there from my side.” You are never alone in your journey.

- Flexible Financial Options: We remove the financial barrier with a no-cost EMI facility for our training and material fees. This allows you to start your CPA journey immediately and pay in easy monthly installments.

From your first eligibility check to the day you earn your license, we are with you at every step.