What Is FMAA Certification? How to Master the Language of Business in 4 Months [2026 Guide]

1. Introduction: What is the FMAA? Your First Step into the World of Finance

Have you ever sat in a business meeting and felt lost when terms like “EBITDA,” “cash flow,” or “budget variance” were discussed? For many talented professionals outside of finance, this can be a major barrier to growth. The FMAA (Financial and Managerial Accounting Associate) certification is designed to break down that barrier.

Positioned by the prestigious, 100-year-old IMA (Institute of Management Accountants), the FMAA certification is the official “foundational level course” in their suite of world-renowned qualifications.

So, what is FMAA? Its core purpose is to build a strong, essential foundation in the universal “language of business”-accounting and finance. It’s designed to give you the core skills and confidence to understand, interpret, and contribute to financial discussions in any professional setting.

Think of it this way: you wouldn’t try to write a novel without first learning the alphabet. The FMAA is the alphabet of business, providing the essential building blocks you need for a successful and impactful career.

2. Who is the FMAA For? A Guide for Students & Non-Finance Professionals

Choosing the right course for your specific career stage is crucial for success. The FMAA certification is not a one-size-fits-all program. Based on Prakash Sir’s extensive experience, it is specifically designed to provide maximum value to two key groups.

For Young Students (Class 10-12 and beyond)

If you are a student planning a career in commerce, the FMAA is a powerful head start.

- It’s a “very good career choice” to build a strong foundation before you even start your degree.

- It strengthens your profile significantly when applying to top universities, especially abroad.

- It gives you a practical understanding of business that goes beyond textbook theory.

For Non-Finance Professionals (Engineers, IT, Marketing, etc.)

This is the group that can benefit most from the FMAA. If you have a science, engineering, or any non-commerce background, this course is for you.

“Many have this problem that they have not studied accounting [and] finance and they don’t [are not] able to contribute in the organization… For them, this is the course.” – Prakash Saraf

The FMAA will equip you with the fundamental “business language” you need to:

- Confidently participate in financial discussions.

- Understand how your department’s performance impacts the company’s bottom line.

- Collaborate more effectively with finance teams and senior management.

An Important Note for Commerce Graduates

Prakash Sir offers a piece of refreshingly honest advice:

“If you have done B.Com and all that, I will advise in place of FMAA we should be going straight away for CMA US… This [FMAA] is not required.”

For commerce graduates, the FMAA covers topics you have already studied. Your next logical step for a global career is the more advanced CMA (Certified Management Accountant) US certification. This honest guidance is a cornerstone of our advisory approach.

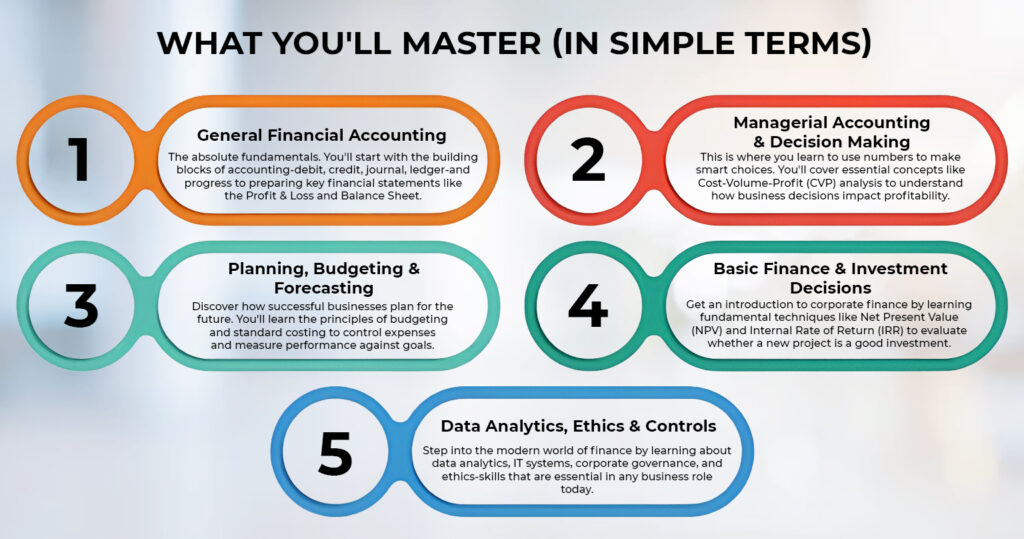

3. The FMAA Syllabus Unpacked: Your A-Z of Business Fundamentals

The FMAA syllabus is designed to be a comprehensive, 360-degree introduction to the world of accounting and finance. It covers all the essential topics you need to build a rock-solid foundation, moving logically from the basics to more advanced concepts.

Here’s a simple breakdown of the core pillars of the FMAA course content, as outlined by Prakash Sir:

This practical toolkit ensures that upon completion, you will not only understand the numbers but also the story they tell about a business.

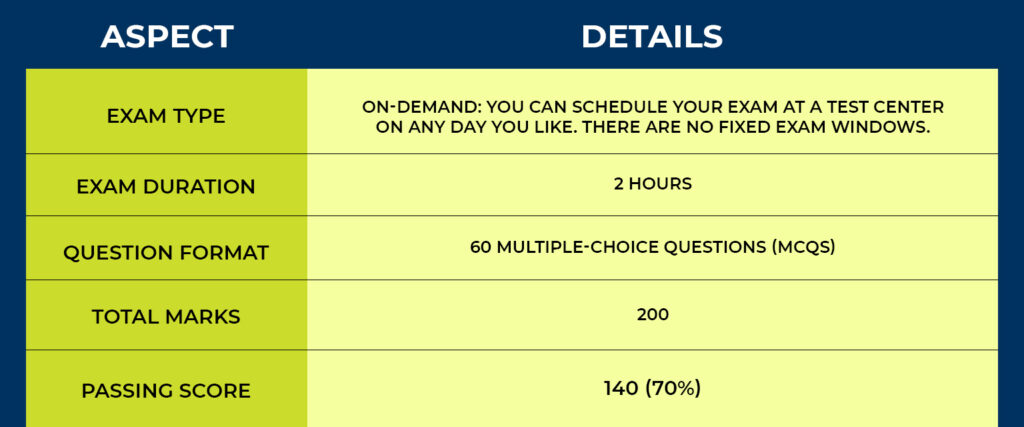

One of the most appealing aspects of the FMAA certification is its straightforward and flexible exam format. It’s designed to be an accessible test of your foundational knowledge, not a barrier to your progress.

As Prakash Sir explains, the entire process is built for convenience and clarity. Here’s a simple breakdown of the FMAA exam pattern:

The Key Advantages of This Format:

- Study at Your Own Pace: The on-demand nature means you are in complete control. You can take the exam as soon as you feel prepared, whether that’s in three months or four. You don’t have to rush or wait for a specific exam date.

- A Clear and Objective Test: The 100% multiple-choice format makes the exam a clear test of your conceptual understanding. It’s a straightforward assessment without the ambiguity of essay-style questions, which is ideal for a foundational level certificate.

With a focused study plan of just 2-3 hours a day, most students can be fully prepared to pass the FMAA exam in as little as 3 to 4 months.

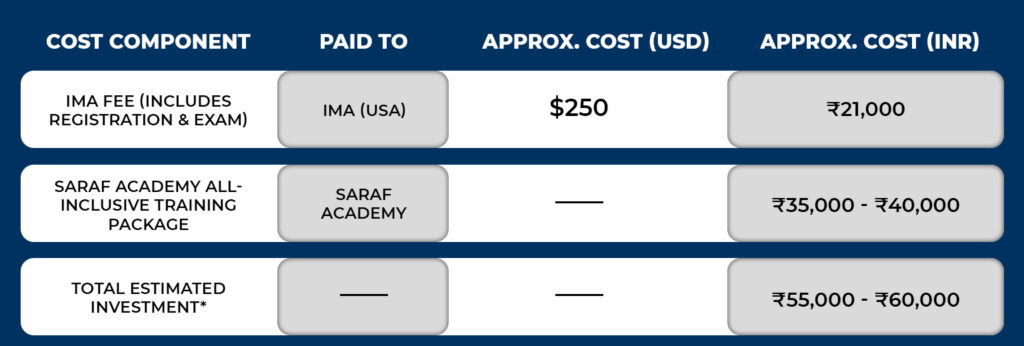

5. A Transparent Breakdown of FMAA Fees in India

The FMAA is one of the most affordable and high-value global certifications available for building your finance and accounting foundation. At Saraf Academy, we believe in complete transparency regarding the investment.

As Prakash Sir outlines, the total FMAA certification cost is approximately ₹55,000 – ₹60,000. This all-inclusive investment covers your IMA registration, exam fee, and expert training.

Here is a clear breakdown of the FMAA exam fees and training investment:

*Note: The IMA Fee is paid in US Dollars ($), and the final INR amount can vary slightly with currency exchange rates.

The Saraf Academy package is a complete solution, including:

- Over 100 hours of live, interactive classes.

- Certified study materials.

- Personalized doubt-clearing and mentorship.

This one-time investment provides you with a globally recognized certificate and a lifelong skill in the language of business.

6. The Real ROI of FMAA: Building a Foundation for Future Success

When considering any qualification, the most important question is: “Is FMAA worth it?” For a foundational course like the FMAA, the return on investment (ROI) isn’t about an immediate six-figure job, but about building the crucial foundation that makes future success possible.

The benefits of FMAA are tailored to its specific audience:

The FMAA is not just a certificate; it’s the solid ground upon which you can build a tall and successful career.

7. The Saraf Academy Advantage: Live Classes & Flexible Learning for All

Choosing the right partner is crucial when you’re building a new skill from the ground up. At Saraf Academy, we provide a unique learning environment that combines structured teaching with the flexibility that modern students and professionals need.

When looking for the best FMAA coaching, it’s important to find a provider who is transparent about their methodology. Here’s our approach:

A Unique Hybrid Learning Model

Our program is designed to cater to both full-time students and busy working professionals.

- Live Classes for Students: Our live, interactive classes are held on weekday afternoons (Monday and Thursday at 3:30 PM IST). This schedule is perfect for school and college students to attend after their regular classes.

- Flexible Learning for Professionals: We understand that professionals cannot attend afternoon classes. The FMAA program is therefore designed for your success through a robust recording-based system.

Unwavering Support, No Matter How You Learn

The most important part of our promise is that flexibility does not mean you’re on your own.

“If the student do recordings, they can ask their doubts… they can call, message anything, that is not a problem.” – Prakash Saraf

Whether you attend the FMAA online classes live or study from the recordings, you get the same level of unwavering support. Every student has direct access to our faculty for personal doubt-clearing. This ensures that every question is answered and every concept is clear, giving you the confidence you need to succeed.

8. FMAA vs. CMA: Which IMA Certification is Your Next Step?

Since both the FMAA and the prestigious CMA (Certified Management Accountant) are offered by the IMA, a very common and important question arises: “Which one is right for me?”

Understanding the strategic path is key. As Prakash Sir clarifies, the IMA has designed a clear ladder of progression: FMAA is the foundational step, and CMA is the professional level. They are not competitors; they are two stages of a successful career journey.

Here is a simple breakdown to help you choose your correct starting point:

| Aspect | FMAA (The Foundation) | CMA (The Professional Level) |

| Level | Foundational / Beginner: The first step into the world of finance. | Intermediate / Professional: A globally recognized expert-level certification. |

| Ideal Candidate | – Students (Class 10-12 and early university). – Non-Finance Professionals (Engineers, IT, Marketing). | – Commerce Graduates (B.Com, M.Com). – Working accountants and finance professionals. |

| Core Skills | The basic “language of business”-learning debit/credit, budgeting, and financial statements. | Advanced management accounting, strategic financial management, risk analysis, and decision support. |

| Simple Analogy | FMAA is like learning the alphabet of finance. | CMA is like writing the business novel. |

The Bottom Line (Direct Advice from Prakash Sir):

- If you are a student just starting out or a professional from a non-commerce background, start with FMAA to build a strong, confident base.

- If you are a commerce graduate or an existing finance professional, go straight to the CMA. The FMAA would be a repetition of what you already know.

9. Conclusion: Your First Step on a Global Career Ladder

The journey to a successful global career is a marathon, not a sprint. Every great journey begins with a single, confident first step. The FMAA certification is that perfect first step.

- For the ambitious student, it’s a head start-a globally recognized credential from the 100-year-old IMA that sets you apart from your peers before you even finish your degree.

- For the determined professional, it’s a bridge-the essential toolkit that allows you to confidently “speak the language of business” and unlock your full potential within your organization.

The FMAA is more than just a certificate; it’s an investment in a solid foundation upon which you can build a lasting and successful career in the dynamic world of global finance and accounting.