In today’s competitive world, having a globally recognized qualification can uplift your career to new heights and will help you achieve new levels of success. And if you are an accounting or commerce student who just loves crunching numbers and aspires to be the driving force behind any business,then the ACCA course may be the right option for you.

So, if you are interested in developing a career as an ACCA professional, this is the blog for you. In this blog, we will give a 360 degree view of what ACCA is, what is the eligibility criteria, how to study, and all the queries you may have.

What Is ACCA?

ACCA is a leading global accounting body that provides professional accounting education and training to individuals who aspire to become chartered certified accountants. The organization offers a comprehensive curriculum that covers a wide range of accounting and finance topics, including financial accounting, management accounting, corporate reporting, taxation, audit, and business analysis. Through its rigorous and globally recognized qualification program, the ACCA aims to equip students with the knowledge, skills, and ethical values necessary to succeed in the accounting and finance profession.

The ACCA qualification is highly respected by employers worldwide, as it is designed to meet the needs of the ever-evolving accounting and finance industry. The qualification is also flexible and can be tailored to meet the specific needs of individuals, depending on their career aspirations and experience. As a result, the ACCA qualification offers diverse career opportunities in various sectors, such as public practice, industry, financial services, and the public sector.

For more information, you can check out this video:

What is the eligibility Criteria?

- Students must have passed their 10+2 exams with an overall score of 65% in Mathematics/Accounts and English, and a minimum of 50% in other subjects, in order to be eligible to register for the ACCA qualification.

- Students who have recently passed their class 10 exams or who do not meet the requirements listed above can still sign up for the ACCA Course through the Foundation in Accountancy (FIA) route.

What is the ACCA Syllabus?

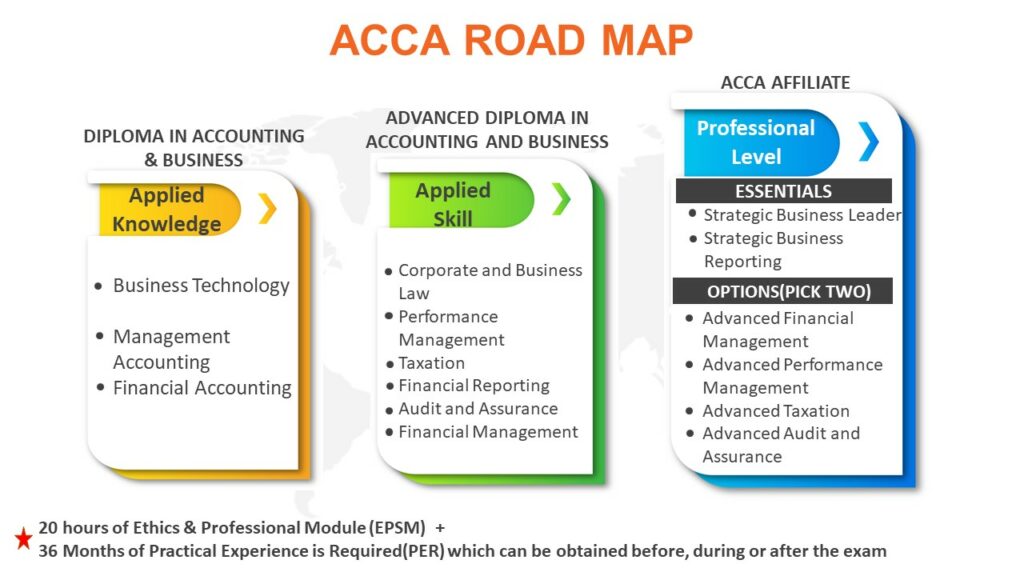

The ACCA syllabus consists of 13 exams that are divided into four levels – Applied Knowledge, Applied Skills, Strategic Professional, and Ethics and Professional Skills module. Here’s an overview of the ACCA syllabus:

- Applied Knowledge: This level includes three exams that cover the fundamental principles of accounting and finance. The exams are Accountant in Business (AB), Management Accounting (MA), and Financial Accounting (FA).

- Applied Skills: This level includes six exams that build on the knowledge gained in the Applied Knowledge level. The exams are Corporate and Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit and Assurance (AA), and Financial Management (FM).

- Strategic Professional: This level consists of two modules – Essentials and Options. The Essentials module includes two exams – Strategic Business Leader (SBL) and Strategic Business Reporting (SBR). The Options module includes four exams, out of which you need to choose two exams from the following options: Advanced Financial Management (AFM), Advanced Performance Management (APM), Advanced Taxation (ATX), and Advanced Audit and Assurance (AAA).

Ethics and Professional Skills module: This module consists of an online course that covers the professional skills and ethical values required to become a chartered certified accountant

What are the exemptions?

| Qualifications | Number of exams | Exemptions |

| 12th Standard | 13 | None |

| Graduation in Commerce | 9 | BT, MA, FA, LW |

| CA Intermediate | 8 | BT, MA, FA, TX, AA, LW |

| CA Qualified | 4 | BT – FM |

| CMA India Qualified | 4 | BT – FM |

To get a much better understanding of the exemptions, please check out the video:

Who is an ACCA Affiliate?

An ACCA Affiliate is an individual who has completed all the required ACCA exams and met the practical experience requirements but has not yet completed the Ethics and Professional Skills module. Once an individual completes the Ethics and Professional Skills module, they become an ACCA member.

ACCA Affiliates have demonstrated a high level of knowledge and understanding of accounting and finance principles and have passed all the necessary exams to become a qualified Chartered Certified Accountant. They are eligible to use the ACCA designation after their name, which is recognized globally as a mark of excellence in the accounting and finance profession.

To maintain their ACCA Affiliate status, individuals must comply with the ACCA’s continuing professional development (CPD) requirements, which involve undertaking relevant training and development activities to keep their skills and knowledge up-to-date.

What is the scope after you finish your ACCA?

Over the past few years, ACCA in India has seen a tremendous expansion in its market. The top organizations, including PwC, Deloitte, KPMG, EY, Grant Thornton, and BDO, hire candidates who have successfully completed their ACCA and developed professional skills.

They are employed in a variety of roles, including valuations, mergers and acquisitions, forensic auditing, risk advisory, statutory audit, internal audit, and accounting advisory. Similar in profile to CAs, the ACCA salary ranges from 5 to 8 lacs.

Additionally, the global recognition and reputation of ACCA qualifications can open up international career opportunities, making it an excellent choice for those who want to work overseas.

How much will you be required to invest?

The fees required for finishing your ACCA Depends on a variety of factors. But here is a basic breakup of how much you might need to pay. But on an average it may cost you something around INR 1.2 lakhs to 3.5 lakhs depending on your last qualification

Conclusion

Pursuing the ACCA qualification in India can be a worthwhile investment for those interested in a career in accounting and finance. While the fees required may seem daunting, there are often financial aid options available to help make the journey more accessible.

It is important for prospective students to research and understand the fees structure and plan accordingly to avoid any financial hurdles along the way. With dedication and hard work, the rewards of completing the ACCA qualification can lead to a successful and fulfilling career both in India and abroad.